If your tax code has changed from 1250L to 1185L, it means your tax-free Personal Allowance has been reduced by £650, likely due to untaxed income, job benefits, or previous tax underpayments. HMRC adjusts tax codes to ensure you pay the correct tax amount during the year.

Here are the key reasons this change may have occurred:

- You’re receiving taxable job benefits (like a company car or medical insurance)

- HMRC is collecting untaxed income (e.g. rental or savings interest)

- You’re repaying underpaid tax from a previous year

- You’ve started receiving the State Pension

- You have multiple jobs or pensions

- HMRC used outdated or estimated income in your new code

Always check your coding notice and contact HMRC if it seems wrong.

What Does a Tax Code Like 1250L or 1185L Actually Mean?

Understanding your tax code is essential because it determines how much tax your employer deducts from your wages before you even see your payslip.

In the UK, most tax codes start with a number and end with a letter, such as 1250L or 1185L. These codes are issued by HMRC and are based on your Personal Allowance the amount of income you’re allowed to earn each year before paying tax.

The number portion of your code shows how much tax-free income you can have. HMRC simplifies it by dividing your allowance by 10.

For example:

- 1250L reflects a tax-free personal allowance of £12,500

- 1185L reflects a reduced tax-free personal allowance of £11,850

The “L” at the end of the code means you’re entitled to the standard Personal Allowance. This code is used by your employer or pension provider to calculate how much Income Tax should be deducted from your earnings under the PAYE (Pay As You Earn) system.

So, if your tax code has changed from 1250L to 1185L, HMRC is now assuming that your tax-free allowance has dropped by £650.

This change is applied directly through payroll, meaning you may see a higher amount of tax being deducted from your monthly or weekly pay.

Why Would HMRC Reduce My Tax Code?

There are several reasons why HMRC might issue a lower tax code. Typically, this is not a mistake but rather an adjustment based on new or updated information about your income, employment, or benefits. HMRC aims to collect the right amount of tax throughout the year to avoid overpayment or underpayment by the end of the tax year.

A professional from HMRC once explained to me, “We update tax codes when we receive new information that changes a taxpayer’s expected earnings or benefits.

This keeps things accurate in real time.” That conversation helped me understand that tax codes are not fixed numbers, they evolve based on your income and life circumstances.

When your tax code is reduced, it usually means HMRC believes that some of your income is not being taxed at source.

Instead of issuing a one-off bill, they reduce your tax-free allowance so the extra tax is collected gradually through the year.

This helps avoid surprises at the end of the tax year when you file your tax return or get your P60.

What Are the Most Common Reasons for a Tax Code Change?

HMRC may change your tax code for a variety of reasons, many of which are based on new financial information they receive throughout the year.

These changes help ensure you’re taxed accurately as your circumstances evolve. A tax code is not a one-time assignment it can shift when your income, benefits, or tax obligations change.

From my personal experience and discussions with others, here are the most common reasons your tax code might change, along with real-life examples that demonstrate how these changes can unfold.

1. Receiving Taxable Job Benefits (Benefits-in-Kind)

If you’re receiving non-cash benefits from your employer, such as a company car, private medical insurance, or even subsidised accommodation, these are considered Benefits-in-Kind (BiK).

HMRC views these perks as part of your total earnings, and rather than taxing them separately, they’re often factored into your tax code.

When this happens, your Personal Allowance is reduced to cover the value of the benefit, meaning your tax code goes down and you pay more tax through your salary.

Real-life example:

Claire works as a sales manager and was offered a company car as part of her package. Initially, her tax code was 1257L, but shortly after accepting the car, she noticed it dropped to 1170L.

After checking her coding notice, she found that the car benefit was valued at £870, and HMRC reduced her allowance by that amount. Her take-home pay dropped slightly to account for the additional tax.

2. Untaxed Income from Other Sources

Not all income is taxed at source. If you earn income from property rental, freelance work, dividends, or interest from savings, HMRC may adjust your tax code to collect the tax owed on this untaxed income throughout the year.

They do this by reducing your tax-free allowance, meaning your tax code is lowered and more tax is collected from your main salary or pension.

Real-life example:

James is employed full-time but also rents out a flat in London. He receives about £4,000 a year in rental income.

Rather than waiting for him to complete a Self Assessment tax return, HMRC updated his tax code from 1250L to 1100L to deduct additional tax each month.

This allowed them to collect the estimated tax due on his rental income directly from his employment earnings.

3. Underpaid Tax from a Previous Tax Year

If you’ve underpaid tax in a prior year, HMRC might opt to collect the unpaid amount gradually by reducing your current year’s Personal Allowance.

This method is used to prevent the financial burden of a lump sum payment. HMRC will spread the repayment across 12 months by adjusting your tax code.

Real-life example:

Aisha changed jobs mid-year and unknowingly paid too little tax due to overlapping payrolls. HMRC caught the error during year-end processing and calculated she owed £450 in underpaid tax.

Instead of sending her a bill, they amended her tax code to 1212L, reducing her allowance by £450. This way, she repaid the tax gradually over the following year.

4. Starting to Receive a State Pension

The State Pension is taxable, but unlike employment income, tax is not deducted at source. This means HMRC needs to adjust your tax code on any other income, such as from a part-time job or private pension, to collect tax due on your State Pension.

Since the State Pension can’t be taxed directly, HMRC reduces the tax-free allowance applied to your other income sources.

Real-life example:

Michael retired at 66 and began receiving his State Pension along with a small private pension. His original tax code on the private pension was 1257L.

After State Pension payments began, his code dropped to 1177L. HMRC reduced his Personal Allowance by the value of his State Pension to ensure tax was paid indirectly through his private pension income.

5. Having Multiple Jobs or Pensions

When you have more than one income source, HMRC needs to allocate your Personal Allowance properly.

Usually, your main job or pension receives the full allowance, while secondary jobs or pensions receive a different tax code, such as BR (Basic Rate), D0 (Higher Rate), or 0T (No Allowance).

These codes ensure that HMRC collects the right amount of tax from each income source across the year.

Real-life example:

Sophie works part-time at two cafes. Her main job receives the standard 1257L code, but her second employer applies the BR code. At first, she was confused about why more tax was being taken from her second job.

After logging into her Personal Tax Account, she discovered the BR code was applied to ensure that her total income was being taxed correctly, as her allowance was already fully used at her main job.

6. Changes in Job Role or Employment Benefits

If you’ve received a promotion, switched departments, or changed jobs entirely, the benefits or estimated income tied to your new position might trigger a new tax code.

Similarly, if your employer starts offering a benefit that wasn’t previously included (like a car allowance or bonus scheme), your code may be adjusted accordingly.

Real-life example:

Tom was promoted to a senior technician role with a £3,000 annual car allowance. A month later, his tax code dropped from 1257L to 1197L. He initially thought it was a mistake but later found a new benefit had been reported by his employer.

HMRC had reduced his allowance to include the taxable value of the car allowance in his tax code calculation.

Why Has My Tax Code Changed If Nothing Has Changed in My Situation?

This question comes up a lot, and it’s one I’ve asked myself. It can be frustrating to see a change when your job, salary, and financial situation have remained the same. However, it’s possible that HMRC has received new or updated information that you may not be aware of.

Some of the common reasons include:

- HMRC received updated estimates of your income from previous employers or pension providers

- Changes in benefits reported late by employers

- Taxable income or deductions from the previous year are being corrected in the current year

- Data errors, such as outdated employer records or duplicate jobs listed

- Benefits that were previously missed are now being included in your tax code

Sometimes, HMRC uses past data to estimate your current year’s income. So even if your income hasn’t changed, their system may predict it has, resulting in an automatic tax code update.

If you genuinely believe nothing has changed and the adjustment was made in error, you can request HMRC to review the coding notice. I’ve done this before, and while it took a bit of patience, they eventually corrected the mistake.

Why Has My Tax Code Gone Down Instead of Up?

A drop in your tax code usually signals that your personal allowance has decreased. This doesn’t always mean you’re earning more, but rather that more of your income is now subject to tax.

Some of the reasons include:

- Receiving new taxable benefits

- Adding a second job or pension

- HMRC correcting underpaid tax

- Increases in untaxed income

- Revisions of estimated income figures from a prior year

When this happened to me, I assumed there was an error until I discovered HMRC had included a previous year’s self-employed earnings in their forecast. Even though I wasn’t currently self-employed, the system still applied the adjustment until I requested a correction.

In many cases, these reductions in the tax code prevent the need for large tax bills at year-end. HMRC prefers collecting smaller amounts gradually, which can work in your favour if you stay informed.

How Can I Check What My Current Tax Code Means?

Understanding your tax code isn’t as complicated as it seems. You can check it in a few easy ways and verify whether the deductions are accurate.

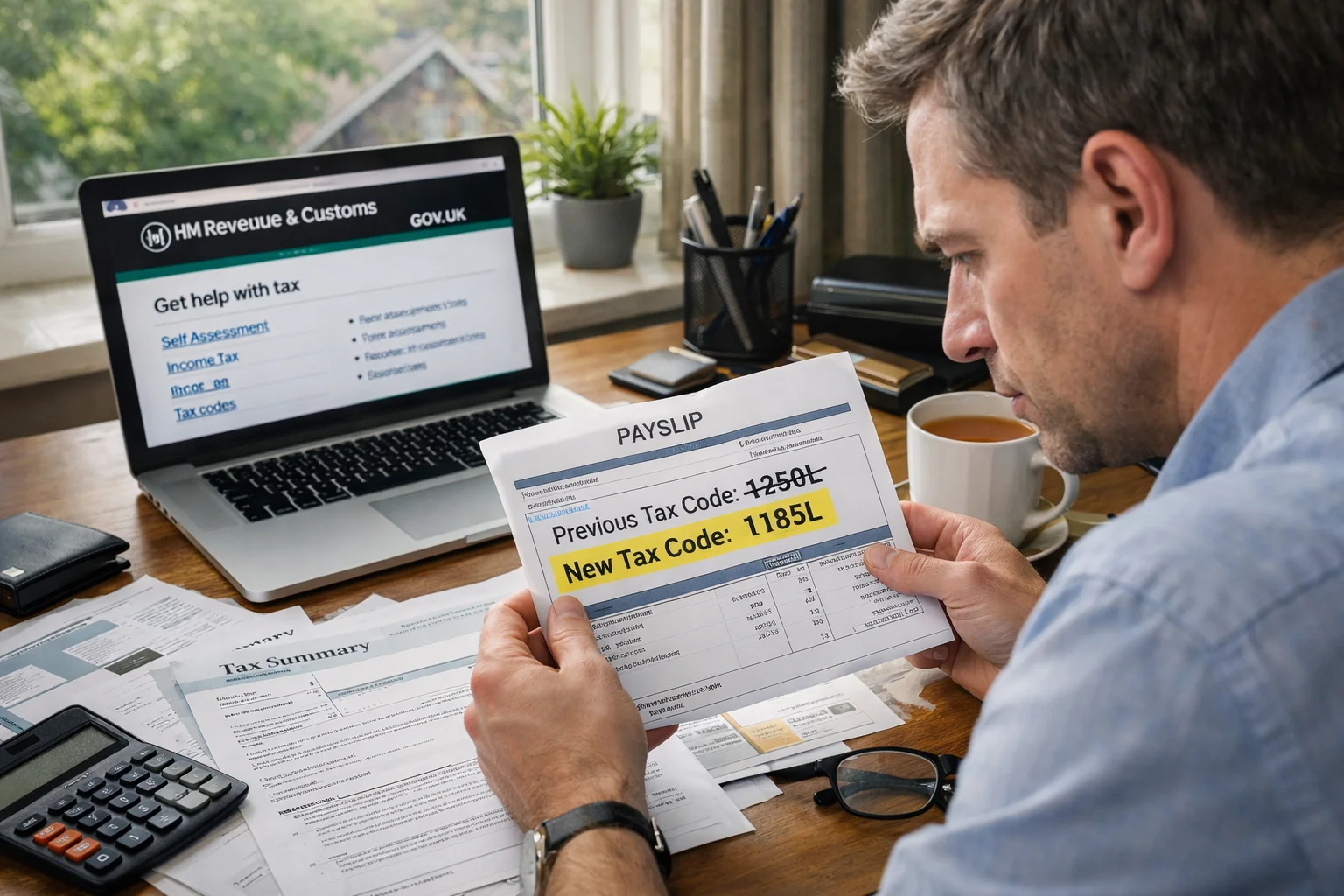

Check Your Payslip

Your payslip will display your current tax code, usually near the top alongside your employee number and pay details.

Use Your Personal Tax Account

Visit the HMRC website and log in to your Personal Tax Account. Here, you can view your tax code, how it was calculated, and the assumptions HMRC has made about your income.

Review the PAYE Coding Notice (P2)

HMRC sends out a PAYE Coding Notice either by post or digitally via your tax account.

It explains:

- What your tax code is

- How much personal allowance you’ve been given

- What benefits or untaxed income are being accounted for

- How much tax you are expected to pay

This is where I first realised why my tax code had changed. HMRC had estimated income from a side business I had closed, but the system had carried that figure forward. I was able to contact them and have it corrected.

Here’s a simple comparison to help you understand your tax code details:

| What You’ll Find in Your P2 Notice | What It Tells You |

|---|---|

| Personal Allowance | The amount of income tax-free for the year |

| Deductions for untaxed income or benefits | Shows how much allowance is reduced |

| Adjustments for underpaid tax | Reflects recovery amount from last year |

| Total taxable income estimate | The total income HMRC expects you to earn |

Keeping an eye on these documents throughout the year ensures you’re not caught off guard when your pay drops unexpectedly.

What Should I Do If I Think My Tax Code Is Wrong?

If you suspect your tax code is incorrect, don’t ignore it. Taking prompt action could save you from overpaying or underpaying tax. Here’s what I’ve done in the past when I questioned my tax code:

1.Review Your Coding Notice Thoroughly

Look at each section to understand how HMRC arrived at the final figure. Make sure all income sources and benefits listed are current and accurate.

2.Use Your Personal Tax Account

Compare your actual income to what HMRC has estimated. This can reveal if they’ve used outdated or incorrect figures.

3.Contact HMRC

You can call them, write, or use the online chat. Be ready with your National Insurance number, employer details, and payslip information.

4. Speak to Your Employer

If the issue involves a benefit provided by your employer, such as a car or medical coverage, your HR or payroll team can help verify the details reported to HMRC.

In my case, one phone call cleared up the issue after HMRC found they had included an old employer’s car benefit that no longer applied. They reissued a new code within two weeks.

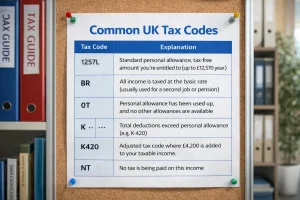

Where Can I See a Full List of UK Tax Codes and Their Meanings?

Tax codes vary based on circumstances.

Here’s a table of some commonly used codes and what they mean:

| Tax Code | Meaning |

|---|---|

| 1257L | Standard tax code for most people with one job or pension |

| 1185L | Reduced Personal Allowance (e.g., due to untaxed income) |

| BR | All income taxed at 20% (used for second jobs) |

| D0 | All income taxed at 40% (higher-rate payers, second jobs) |

| 0T | No Personal Allowance applied |

| NT | No tax is deducted at all |

| K Code | Used when deductions exceed allowances (e.g., K250 = £2,500 added to income for tax purposes) |

HMRC also provides a detailed list of codes and what each letter or prefix represents. However, your own tax code is usually the best starting point because it’s tailored to your situation.

FAQs About Tax Code 1250L Changing to 1185L

What does the “L” at the end of a tax code mean?

It means you’re entitled to the standard tax-free Personal Allowance.

How can I find out why my tax code changed?

Check your PAYE Coding Notice (P2) or log into your HMRC Personal Tax Account.

Can I dispute a change in my tax code?

Yes. You can contact HMRC if the figures seem incorrect or outdated.

Does having a second job affect my tax code?

Yes. HMRC may assign a different code to your second job, often BR or 0T.

Will I get a refund if my tax code was too low?

If you overpay during the year, HMRC will refund you at year-end or via adjustment.

Is 1185L a normal tax code?

It’s a valid but less common code, usually assigned when the standard allowance is reduced.

What’s the difference between an emergency tax and a reduced tax code?

Emergency tax is a temporary code applied until HMRC has your full details. A reduced tax code is based on calculated deductions or benefits.

Leave a Reply