The UK Government has announced a gradual increase in the State Pension age from 66 to 67, taking effect between April 2026 and March 2028.

This change, legislated under the Pensions Act 2014, will affect people born between 6 April 1960 and 5 March 1961. The Department for Work and Pensions (DWP) will notify individuals impacted by the change, detailing their revised State Pension age.

This blog explores the implications of the DWP state pension age change 2026, how it will affect millions across the UK, and what people can do to prepare.

Why Is The UK State Pension Age Changing From 66 To 67?

The UK Government’s decision to increase the State Pension age from 66 to 67 between April 2026 and March 2028 is part of a long-term plan to ensure the sustainability of the pension system.

This adjustment reflects the significant rise in average life expectancy over recent decades and the financial pressure it places on public funds.

People today are living longer and spending more years in retirement. When the State Pension was first introduced in 1948, life expectancy at age 65 was approximately 13 years for men and 15 years for women. Now, those figures are closer to 20 years for men and 22 years for women.

The Government aims to maintain a balance where individuals spend roughly one-third of their adult lives in retirement. The Pensions Act 2014 established a mechanism for reviewing the State Pension age at least once every five years, ensuring it keeps pace with demographic and economic trends.

Key reasons for this change include:

- Longer life expectancy and healthier ageing.

- The need for financial sustainability in the pension system.

- Fairness between generations in funding future pensions.

- Encouraging longer participation in the workforce.

The decision follows several previous adjustments made under the Pensions Acts of 1995, 2007, and 2011, which gradually equalised and increased pension ages for men and women.

When Will The New State Pension Age Changes Take Effect?

The DWP state pension age change 2026 will take effect gradually between April 2026 and March 2028. Instead of setting a single date, the increase will be implemented on a monthly, birth-based schedule, affecting those born between 6 April 1960 and 5 March 1961.

Individuals within this group will see their State Pension age increase by one month for every month they were born after 6 April 1960. For example, someone born in May 1960 will have a pension age one month later than someone born in April 1960.

The table below illustrates the phased approach:

| Date of Birth | New State Pension Age | Date Pension Age Reached |

|---|---|---|

| 6 April 1960 – 5 May 1960 | 66 years and 1 month | May 2026 |

| 6 May 1960 – 5 June 1960 | 66 years and 2 months | July 2026 |

| 6 July 1960 – 5 August 1960 | 66 years and 4 months | November 2026 |

| 6 December 1960 – 5 January 1961 | 66 years and 9 months | September 2027 |

| 6 March 1961 – 5 April 1961 | 67 years | March 2028 |

Individuals can use the official State Pension age calculator on GOV.UK to check their exact retirement age based on their date of birth and gender. This tool helps people plan for retirement and make informed financial decisions.

The change means that anyone born after 5 March 1961 will have their State Pension age fixed at 67 under current legislation.

Who Will Be Affected By The DWP Pension Age Change In 2026?

The gradual increase in the State Pension age from 66 to 67 will primarily affect a specific group of individuals based on their date of birth. This phased change is detailed in legislation and will reshape how millions plan for retirement.

Affected Age Group And Date Of Birth Range

Those born between 6 April 1960 and 5 March 1961 will be directly affected by the DWP state pension age change. These individuals were originally scheduled to reach State Pension age at 66 but will now experience a month-by-month increase, eventually reaching pension age at up to 67.

People born on:

- 6 April 1960 will reach pension age at 66 years and 1 month

- 6 May 1960 will reach it at 66 years and 2 months… and so on, until

- 5 March 1961, who will reach it at 66 years and 11 months

This means that a full additional year of working or financial planning may be required, depending on the individual’s birthdate.

Equal Impact On Men And Women

Previous pension legislation already equalised the State Pension age for men and women. As such, the 2026 change applies equally to both genders. This continues the Government’s goal of providing a uniform retirement age across the UK population.

Those Close To Retirement Face Immediate Impact

The people most affected by this change are those approaching their mid-60s and preparing for retirement in the next few years. Many in this group may have built financial plans, expected retirement timelines, and healthcare decisions around the age of 66.

This group should consider the following:

- Adjusting their personal and workplace pension withdrawals

- Reviewing other sources of income (e.g. savings, annuities)

- Considering alternative retirement dates or phased retirement

Impact On Individuals With Limited Savings

For individuals who may not have significant private pension savings, the delay in accessing the State Pension could lead to financial strain. Those in lower-income brackets or self-employed workers with inconsistent pension contributions may be more vulnerable to the impact of the change.

Proactive planning, use of financial tools, and seeking advice from pension experts can help mitigate the risks associated with this delay.

How Will Individuals Be Informed About Their New Pension Age?

The Department for Work and Pensions (DWP) will notify every person affected by the 2026–2028 changes through an official letter. This communication will confirm the individual’s specific State Pension age and the date they become eligible to claim.

In addition to receiving this notification, individuals can take proactive steps to verify their details and prepare:

- Use the State Pension Age Calculator available on the GOV.UK website.

- Request a State Pension forecast, which provides an estimate of the amount you’ll receive and your eligibility date.

- Review your National Insurance record to ensure you have enough qualifying years to receive the full pension.

Keeping records updated with HMRC and the DWP ensures that individuals receive accurate and timely information regarding their pension age and entitlements.

What Are The Financial And Planning Implications Of The Pension Age Increase?

Raising the State Pension age by one year has wide-ranging effects on retirement planning, personal finance, and career decisions. People approaching the affected age group need to adapt their plans accordingly to ensure financial stability and peace of mind during the transition.

Shift In Retirement Income Timeline

One of the most immediate impacts is the postponement of State Pension income by up to one year. For many, this income forms a core part of retirement funding. Delaying access to it can create an income gap that must be filled through other means.

This means:

- A longer wait for guaranteed income from the State

- A need to draw down on personal savings or private pensions earlier

- A potential reduction in total lifetime pension income if retirement starts earlier than eligibility

Reassessment Of Pension And Investment Strategies

Those nearing retirement should re-evaluate their existing pension contributions and investment strategies. The extra working year may allow individuals to boost pension pots, especially if they are in defined contribution schemes.

Considerations include:

- Increasing pension contributions while still working

- Evaluating whether to defer private pension withdrawals to align with State Pension timing

- Using flexible pension access options from age 55, if available

Need For Contingency Planning

The additional year before accessing the State Pension underscores the importance of financial flexibility. It may be necessary to set aside emergency savings, reduce debt, or rework budgets to accommodate an extended work period or an unexpected early exit from the workforce due to ill health.

Key Planning Actions To Consider

- Check Your National Insurance Record: Ensure you have at least 35 qualifying years for the full State Pension.

- Obtain A State Pension Forecast: Use the GOV.UK tool to see your estimated pension amount and start date.

- Review Workplace And Personal Pensions: Determine whether these can support your retirement before State Pension age.

- Consult A Financial Adviser: Professional guidance can help optimise your retirement timeline.

By staying informed and proactive, individuals can minimise disruption and make informed choices to navigate the pension age shift successfully.

Are There More State Pension Age Increases Planned In The Future?

Yes, further increases are already scheduled under existing legislation. According to the Pensions Act 2007, the next planned rise will increase the State Pension age from 67 to 68 between 2044 and 2046.

However, the Pensions Act 2014 introduced a requirement for regular reviews, meaning the timeline for this change could be brought forward depending on future reports and government decisions. The Government evaluates factors such as life expectancy, employment trends, and public finances when reviewing pension age policies.

The table below summarises the upcoming legislated changes:

| Period | State Pension Age | Legislative Basis |

|---|---|---|

| 2026–2028 | 66 to 67 | Pensions Act 2014 |

| 2044–2046 | 67 to 68 | Pensions Act 2007 |

| Post-2046 | To be reviewed | Future Reviews |

It is possible that future generations may face earlier increases, as government projections suggest a potential rise to 68 by the mid-2030s and 69 by the late 2040s. Any changes will still require Parliamentary approval before they become law.

What Can UK Citizens Do To Prepare For The State Pension Age Change?

Preparing early for the upcoming DWP state pension age change 2026 is essential for anyone approaching retirement. Financial readiness and awareness can significantly reduce the impact of the shift from 66 to 67.

Steps To Prepare:

- Check Your Pension Age: Use the GOV.UK calculator to find your exact State Pension age.

- Request A State Pension Forecast: This will help you understand how much you are likely to receive and identify any shortfalls.

- Review Your Retirement Savings: Assess your workplace and private pensions to ensure they can support you until your State Pension starts.

- Consider National Insurance Top-Ups: If you have missed contribution years, you may be able to make voluntary payments to increase your entitlement.

- Seek Professional Advice: Consulting an independent financial adviser can provide tailored strategies for managing the transition.

Early financial planning not only ensures stability during the change but also helps individuals take advantage of available options for a smoother transition into retirement.

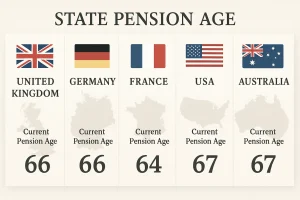

How Does The UK Pension Age Compare To Other Countries?

When comparing pension systems globally, the UK’s planned rise aligns closely with trends in other developed economies. Many nations have already moved towards higher pension ages due to similar demographic pressures.

| Country | Current Pension Age | Planned Increase | Notes |

|---|---|---|---|

| United Kingdom | 66 (rising to 67) | 67 by 2028 | Gradual increase under DWP timetable |

| Germany | 66 | 67 by 2031 | Linked to life expectancy |

| France | 64 | 64 (new reform) | Controversial but implemented |

| USA | 67 | No change planned | Based on birth year |

| Australia | 67 | Fully implemented | Completed in 2023 |

These comparisons show that the UK’s approach is consistent with global efforts to manage public pension systems amid rising longevity. The UK’s phased model provides predictability, giving citizens time to adapt.

Conclusion

The upcoming DWP State Pension age change from 66 to 67, taking place between 2026 and 2028, marks a significant shift in the UK’s retirement landscape.

Aimed at ensuring the sustainability of the pension system, this change will impact those born between April 1960 and March 1961.

It is essential for individuals approaching retirement to stay informed, review their financial plans, and use available tools like the State Pension calculator to prepare effectively for this adjustment.

Frequently Asked Questions about the State Pension age increase

Will the pension age rise again after 2028?

Yes. The next legislated increase is from 67 to 68, scheduled between 2044 and 2046, though reviews may lead to earlier changes.

Can I still retire early before 67?

You can retire at any age, but you won’t receive your State Pension until your designated age. Private or workplace pensions may offer early access options, usually from age 55.

Does this affect private pensions too?

No. The change applies only to the State Pension. However, you may need to bridge the gap if your private pension begins before your new State Pension age.

Will people on benefits be impacted by this change?

Some benefits linked to retirement age may be affected, such as Pension Credit. It’s essential to check eligibility as your retirement age changes.

How do I appeal my pension age if it seems incorrect?

You cannot appeal the pension age itself, but if you believe your date of birth or National Insurance record is wrong, contact the DWP to request a correction.

What if I have health issues and can’t work longer?

If you’re unable to work due to health, you may qualify for other benefits such as Employment and Support Allowance (ESA) or Universal Credit. The State Pension age remains unchanged.

How do I know my exact pension date?

Use the State Pension age calculator on GOV.UK, or refer to your DWP letter for confirmation of the exact date you can start claiming.

Leave a Reply