Yes, a gift of money can affect your UK benefits. A cash gift is usually treated as capital (savings) rather than income, but it can reduce or stop means tested benefits if it increases your total savings above the set thresholds.

If your capital stays under £6,000, it normally has no effect. Savings between £6,000 and £16,000 can reduce payments such as Universal Credit, while savings over £16,000 usually mean you are no longer eligible.

Giving money away to keep benefits may be treated as deprivation of capital, meaning the Department for Work and Pensions (DWP) can still count the money as yours. All gifts should be declared.

Key points:

- Gifts are usually classed as capital, not income

- Capital under £6,000 usually does not affect benefits

- Capital between £6,000 and £16,000 reduces entitlement

- Capital over £16,000 usually stops means tested benefits

- Regular gifts may be treated as income

- Gifts from family or overseas count the same way

- Giving money away to stay eligible can lead to penalties

- All gifts must be reported to the DWP or local council

Can Receiving a Gift of Money Affect My Universal Credit?

Gifts of money can directly impact Universal Credit if the value of the gift increases your total capital beyond the thresholds set by the Department for Work and Pensions (DWP).

Universal Credit is a means-tested benefit, and your eligibility is influenced not only by income but also by savings and other forms of capital.

The DWP applies capital thresholds to determine how much Universal Credit a person or household is entitled to receive:

| Capital (Savings) Total | Impact on Universal Credit |

| £0 to £6,000 | No effect on payment |

| £6,000 to £16,000 | Universal Credit is reduced incrementally |

| Over £16,000 | Ineligible for Universal Credit |

For each £250 over the £6,000 lower threshold, Universal Credit is reduced by £4.35 per month.

This reduction is known as “tariff income” and is based on the assumption that you are earning interest or income from your savings.

Even if a gift is a one-time transfer from a friend or relative, if it takes your capital over these limits, your benefit entitlement will be reviewed.

The full amount of the gift is added to your existing savings, regardless of whether you intend to spend it soon after.

In practice, if you already have £5,500 in savings and receive a £2,000 gift, your capital will total £7,500.

This places you within the reduced entitlement band, and your monthly payment will be adjusted accordingly.

Is a Gift of Money Treated as Income or Capital by the DWP?

The classification of money as either income or capital is crucial when determining its impact on benefits.

According to current benefit rules and DWP guidance:

- One-off, voluntary cash gifts from family or friends are generally not counted as income.

- Instead, they are treated as capital, meaning they form part of your overall savings.

This distinction matters because regular income, such as wages, pensions, or support payments, affects benefits differently than capital.

While income affects Universal Credit on a pound-for-pound basis (after applicable work allowances), capital only starts to affect benefits once it exceeds specific thresholds.

Gifts that are received regularly or form a pattern, such as monthly transfers from a relative, may be considered income rather than capital.

This could have a more immediate and severe impact on benefits, particularly where no disregard applies.

The general rule is:

- One-off gift: Capital

- Regular support: Potentially income

It’s important to clarify the nature of any monetary support with the DWP to avoid misclassification.

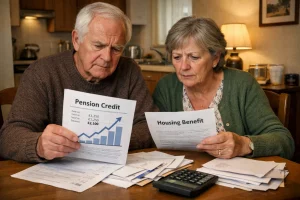

How Do Gifts Affect Other Means-Tested Benefits Like Pension Credit or Housing Benefit?

The rules for handling gifts of money are broadly similar across means-tested benefits, although there are some variations depending on the benefit type and the claimant’s age.

For example:

- Pension Credit uses the same capital thresholds as Universal Credit.

- Housing Benefit and Council Tax Reduction (administered by local authorities) also consider capital when calculating entitlement.

- Income Support, Income-Based Jobseeker’s Allowance (JSA), and Income-Related Employment and Support Allowance (ESA) follow identical rules to Universal Credit in terms of capital limits.

A second table below illustrates how gifts can impact other types of benefits:

| Benefit Type | Capital Thresholds | Impact of Gifted Money |

| Pension Credit | £10,000 (no upper limit) | Tariff income applies from £10,000 upwards |

| Housing Benefit | £6,000 to £16,000 | Reduction in entitlement; over £16,000 = no support |

| Council Tax Reduction | £6,000 to £16,000 | Affects reduction level or eligibility |

| Income-Based JSA/ESA | £6,000 to £16,000 | Payment reduced; over £16,000 = ineligible |

In most cases, claimants must report any change in capital to their local council or Jobcentre.

Failing to do so could result in an overpayment, which may need to be repaid, and in some cases, can lead to benefit fraud investigations.

What Happens If My Savings Go Over the Threshold Because of a Gift?

When a gift causes your total capital to increase beyond one of the set thresholds, the effect is immediate from the point the money becomes accessible.

The process generally works as follows:

- The money is deposited in your account or received in another accessible form.

- The DWP is notified (either by you or during routine checks).

- Your capital is reassessed.

- Benefit payments may be adjusted from that point forward.

Here’s how it breaks down:

- Up to £6,000: No change to benefit amount.

- £6,000 to £16,000: Benefits are reduced based on notional income (e.g., £4.35 per £250 over £6,000).

- Over £16,000: You are no longer entitled to most means-tested benefits.

This can happen regardless of whether you intend to spend the money soon or are holding it temporarily. It’s the presence of the capital not its intended use that matters in the assessment.

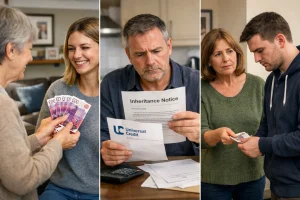

Can I Give Money Away to Stay Eligible for Benefits?

Giving away money to remain under capital thresholds can lead to serious consequences if the DWP considers it deprivation of capital.

Deprivation of capital occurs when a person intentionally reduces their capital to either:

- Increase their benefit payments

- Maintain eligibility for a benefit they would otherwise not qualify for

This can include:

- Gifting large sums to family or friends

- Donating money

- Gambling it away

- Making unreasonable purchases

The DWP can treat the money as notional capital, which means they will assess your benefits as if you still have that money.

Some examples of actions that may be considered deprivation of capital:

- Giving £10,000 to your adult child when your savings are close to £16,000

- Donating half your inheritance to a friend just before making a benefit claim

- Taking an extended holiday immediately after receiving a large cash gift

If the DWP determines that the capital was deliberately spent or given away to gain or increase benefit entitlement, they may:

- Refuse your claim

- Reduce your entitlement

- Require repayments if the claim has already been processed

Claimants have the right to challenge these decisions through a mandatory reconsideration and, if necessary, appeal to a tribunal.

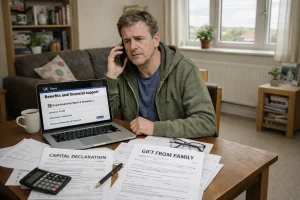

What Are the Rules for Reporting a Financial Gift to the DWP?

You are required to report any financial change that may affect your benefits, including receiving a gift of money.

This is part of the claimant commitment and ensures transparency and compliance with benefit regulations.

To report a gift:

- Use your online Universal Credit journal

- Contact the Universal Credit helpline

- Notify your local authority (for Housing Benefit or Council Tax Reduction)

- Inform The Pension Service (for Pension Credit)

Information to provide includes:

- The amount received

- Who the gift was from

- The date received

- How the money was used or whether it remains in savings

Failure to report a gift can result in:

- Benefit overpayments

- Investigations into possible fraud

- Recovery of payments and sanctions

According to Citizens Advice, it is always safer to report any financial change, even if you are unsure whether it needs to be declared. This ensures your record remains accurate.

Does a Gift from Overseas or Family Count Towards My Benefits?

Yes. The origin of the money does not change its classification. Gifts from family living abroad, friends overseas, or international transfers are treated exactly the same as UK-based gifts for benefit purposes.

Even if the money is received in a different currency, once it is converted and deposited into your account, it is considered capital. The DWP expects it to be declared like any other monetary change.

This includes:

- Bank transfers from overseas accounts

- Cash given while visiting another country

- Online transfers via services like PayPal or Wise

The DWP may request additional information, such as bank statements, to understand the source and purpose of the funds. If the gift is significant, it could lead to further scrutiny regarding its impact on your eligibility.

How Much Money Can I Gift to a Family Member Tax-Free in the UK?

When it comes to gifting money to others, such as family members, tax rules and benefit rules are separate. HMRC allows certain gifts to be given without incurring Inheritance Tax, subject to annual exemptions.

The current HMRC tax-free allowances include:

- £3,000 annual exemption per tax year (can be carried over one year)

- £5,000 for gifts to children on marriage or civil partnership

- £2,500 for grandchildren on marriage

- £250 per person for small gifts, provided they haven’t received another gift that year

These tax-free gifts are helpful for estate planning, but if you’re a benefits claimant and give away money under these allowances, the DWP may still treat it as deprivation of capital if they believe it was done to maintain benefit eligibility.

The safest approach is to retain clear documentation showing the purpose and timing of any gifts made, particularly when claiming means-tested support.

Do I Have to Pay Tax on a Cash Gift from My Parents?

Generally, you do not pay tax when receiving a gift of money, whether it’s from your parents or anyone else.

- Gifts are not treated as income for tax purposes.

- There is no tax liability for the recipient at the time of receiving the gift.

- The gift may only become subject to Inheritance Tax if the donor dies within seven years of giving the gift and the total value of gifts exceeds the nil-rate band.

This does not affect benefit assessments. Even if no tax is owed, the amount of the gift is still counted as capital and can reduce or remove eligibility for means-tested support.

For instance, if you receive £10,000 from a parent, this won’t be taxed, but it will push your capital over the £6,000 threshold and reduce your Universal Credit unless it’s spent on exempt items.

What If I Spend the Gifted Money Quickly – Does It Still Count?

Spending gifted money quickly may reduce or eliminate its impact on your benefit assessment if the spending is reasonable and essential.

Acceptable uses of a cash gift may include:

- Paying off rent arrears or loans

- Buying or repairing essential household items

- Covering urgent medical or family expenses

- Clearing council tax debts

Once money is spent on necessary items, it is no longer considered part of your capital. However, claimants should retain evidence of all spending, such as:

- Receipts

- Bank statements

- Invoices

Spending that may raise concerns includes:

- Transferring money to others without a clear reason

- Purchasing luxury or non-essential items

- Splitting the money into multiple accounts to hide it

The DWP may request evidence to ensure the spending was genuine and not an attempt to reduce capital deliberately.

Examples: How Gifted Money Affects Benefits in the UK?

These real-life style scenarios help illustrate how different types of monetary gifts can affect a person’s entitlement to means-tested benefits in the UK.

They reflect how the Department for Work and Pensions (DWP) assesses capital, applies thresholds, and determines if there has been any deprivation of capital.

Example 1: Small Gift from a Relative (No Impact)

Scenario:

Alice is a Universal Credit claimant with £4,800 in her savings account. Her sister gives her a one-off cash gift of £500 as a birthday present, which Alice deposits into her bank account.

Total savings after gift: £5,300

Assessment:

Since Alice’s total capital remains below the £6,000 threshold, the DWP does not reduce her Universal Credit.

The gift is treated as capital, not income, and is therefore simply added to her overall savings balance.

Alice reports the change using her Universal Credit online account, which is considered good practice even when no impact is expected.

Result:

- No change to benefit entitlement.

- No reporting issue because the gift is declared properly.

- Alice continues receiving the same Universal Credit payment.

This example shows that gifts under £6,000 in total capital have no effect on Universal Credit or most other means-tested benefits.

Example 2: Inheritance Gift (Reduction in Entitlement)

Scenario:

John is single and claiming Universal Credit. He currently has £5,000 in savings. He inherits £10,000 from an uncle’s estate, which is deposited into his bank account in a single lump sum.

Total savings after gift: £15,000

Assessment:

Because John’s capital now exceeds the £6,000 lower threshold, the DWP applies a tariff income calculation. For every £250 over £6,000, they assume £4.35 of monthly income when calculating his entitlement.

- Excess capital: £15,000 – £6,000 = £9,000

- Tariff income: £9,000 ÷ £250 = 36 units × £4.35 = £156.60/month

This £156.60 is treated as notional income, which reduces John’s Universal Credit payment each month. He continues to receive some benefit because his capital is below £16,000, but at a reduced rate.

John correctly reports the inheritance, and he is advised to retain evidence of the source of the funds in case of future queries.

Result:

- Universal Credit is reduced due to increased capital.

- John remains eligible, but his payment amount drops.

- No penalty or investigation because he declared the gift properly.

This example highlights how lump-sum gifts or inheritances between £6,000 and £16,000 result in partial benefit reductions.

Example 3: Deprivation of Capital (Disqualification)

Scenario:

Nina is receiving Housing Benefit and Council Tax Reduction through her local council. She has no significant savings when she receives £17,000 as a gift from her grandfather.

Soon after receiving the money, Nina transfers £15,000 to her adult son to help him buy a car and pay off his debts. She keeps only £2,000 in her account and contacts her local authority to report her remaining savings.

Assessment:

When reviewing her case, the local council becomes concerned that Nina gave away most of the money immediately to avoid losing her entitlement. An investigation is carried out to determine whether this was a case of deprivation of capital.

The council assesses that:

- The timing of the transfer (soon after the gift)

- The size of the gift (£17,000)

- The fact that she was claiming benefits at the time

…all indicate that Nina deliberately gave away capital to remain eligible for Housing Benefit and Council Tax Reduction.

As a result, the local authority treats the £15,000 she gave away as “notional capital.”

This means they assume she still has access to the money, and her benefits are reassessed as if the full £17,000 remains in her possession.

Since the notional capital exceeds £16,000, she is now ineligible for both Housing Benefit and Council Tax Reduction until her assumed capital falls below the threshold.

Result:

- Benefits stopped due to notional capital assessment.

- Nina must fund her housing and council tax until her notional capital would have reasonably been spent.

- The council advises her she may reapply once the notional capital is considered depleted over time.

This case demonstrates how attempts to give away money to preserve benefits can backfire and result in suspension or termination of support. Even if gifts are well-intentioned, they can trigger deprivation of capital rules if they’re not justified and reported transparently.

Summary: Key Facts About Gifts and UK Benefits

-

Gifts of money count as capital, not income

-

Savings over £6,000 can reduce benefits; over £16,000 can disqualify you

-

Gifts from family or overseas are treated the same way

-

You must report all gifts to DWP or your council

-

Giving money away could lead to benefit penalties

-

Spending the money reasonably can prevent capital increases

Frequently Asked Questions

How does a one-time gift affect my Universal Credit in the UK?

A one-off gift is counted as capital. If it pushes your savings over £6,000, it may reduce your Universal Credit.

Can I refuse a cash gift to stay eligible for benefits?

Yes. You are not required to accept money, especially if it could impact your benefits.

Is help from family considered income by the DWP?

No. Occasional, voluntary gifts are considered capital, not income, under benefit rules.

What’s the difference between income and capital in benefit assessments?

Income is regular money you receive (e.g., wages), while capital refers to savings or lump sums like gifts.

Are bank transfers from overseas counted as savings?

Yes. Even overseas gifts are added to your total capital and can affect means-tested benefits.

Can I still claim benefits if I inherit a small sum of money?

Yes, as long as your total capital stays below £16,000. Between £6,000 and £16,000 will reduce payments.

Do I need to report every gift I receive to DWP?

Yes. Any financial gift that changes your savings should be reported as a change in circumstances.

Leave a Reply