Yes, you can defer your State Pension in the UK by simply not claiming it when you reach State Pension age. Deferral can increase your future pension, but the outcome depends on when you reach pension age and your circumstances.

Key answers explained in this guide:

- New State Pension increases by 1% every 9 weeks deferred, while the basic pension increases by 1% every 5 weeks

- Lump sums with interest are only available for those who reached pension age before April 2016

- You cannot build an extra pension while claiming Universal Credit or Pension Credit

- If you die during deferral, some or all of the pension may be inherited

- Spouses or civil partners may receive inherited payments if eligibility rules are met

- Deferral is possible abroad and can be done more than once

How Does Deferring Your State Pension Work?

If you reach State Pension age and do not apply for your pension, it’s automatically deferred. You don’t need to contact anyone unless you later want to claim it. The options available to you will depend on when you were born and whether you reached State Pension age before or after 6 April 2016.

If you reached State Pension age on or after 6 April 2016, you can:

- Receive extra regular payments

- Backdate your claim by up to 12 months and receive a one-off arrears payment

- Combine the two (i.e., get 12 months as arrears and the rest as increased weekly income)

If you reached State Pension age before 6 April 2016, the rules are slightly different. You can choose between:

- A one-off lump sum (with interest)

- Increased weekly payments

Note: You can’t have both unless you deferred before 2005.

How Much Extra Money Can You Get From Deferring?

The financial return from deferring your State Pension depends on how long you delay your claim and which pension system applies to you.

If you reached State Pension age on or after 6 April 2016, for every 9 weeks you defer, your payments increase by 1%. This amounts to about 5.8% extra for every full year of deferral.

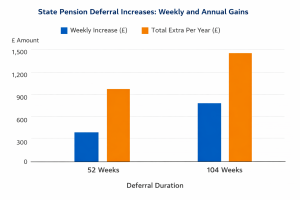

Let’s look at an example:

| Deferral Duration | Weekly State Pension | Weekly Increase | Total Extra per Year |

|---|---|---|---|

| 52 weeks | £230.25 | £13.35 | £694.20 |

| 104 weeks | £230.25 | £26.70 | £1,388.40 |

If you reached State Pension age before 6 April 2016, for every 5 weeks you defer, your pension increases by 1%, which equates to about 10.4% per year.

Example for basic State Pension:

| Deferral Duration | Weekly State Pension | Weekly Increase | Total Extra per Year |

|---|---|---|---|

| 52 weeks | £176.45 | £18.35 | £954.20 |

These figures help illustrate how deferring can significantly boost your income, especially if you’re in good health and expect to live long enough to benefit from the higher weekly payments.

Can You Take A One-Off Payment Instead?

Yes, but only in certain circumstances. If you reached State Pension age on or after 6 April 2016, you can backdate your claim by up to 12 months and receive a one-off arrears payment. No interest is added to this amount.

For example:

- Deferring for 52 weeks results in a one-off payment of £11,973

- Deferring for 27 weeks gives you £6,216.75 as a single payment

If you defer for more than 52 weeks, the first 12 months can be paid as a lump sum, and the rest will be added to your weekly pension.

If you reached State Pension age before 6 April 2016, you can defer for at least 12 months and request a lump sum that includes interest 2% above the Bank of England base rate.

This option is attractive to those who prefer immediate access to cash, especially if there’s a financial need or if you’re unsure about future life expectancy.

What Are The Rules If You’re Already Claiming?

This is a common question: Can you defer your State Pension after you’ve already claimed it?

Yes, in some cases, you can suspend your pension once it’s in payment and restart it later. This allows you to build up more deferred income. However, you can’t keep switching it on and off multiple times without restrictions. It’s essential to speak to the Pension Service before making such a decision.

There’s also a misconception that you can defer for short periods like 3 or 6 months. While technically possible, deferral benefits only start accumulating after a minimum of 9 weeks (for new pensions) or 5 weeks (for basic pensions). Therefore, short deferrals may not make a significant difference.

From a personal viewpoint, I found this part of the process surprisingly flexible. When I explored this option myself, I was reassured to know that deferral isn’t a permanent decision; you can change your mind later, though you must act carefully to follow the right channels.

How Will Your Benefits Be Affected If You Defer?

Deferring your State Pension may affect your entitlement to certain income-related benefits, including:

- Pension Credit

- Universal Credit

- Income Support

- Housing Benefit

- Council Tax Reduction

If you or your partner receives any of these, you cannot accumulate deferred pension benefits during that time. Also, once you start receiving your deferred payments, your benefits may be reduced, especially if the extra income takes you above the threshold.

You must inform the Pension Service if you are receiving any of these benefits and plan to defer. This is critical because time spent receiving benefits does not count towards your deferral period.

Here’s a brief overview:

| Benefit Status | Can You Defer and Build Extra Pension? |

|---|---|

| Receiving income-related benefits | No |

| Partner receiving benefits | No |

| Not claiming any benefits | Yes |

If you’re unsure, contact Jobcentre Plus or the Pension Service for clarification. I strongly recommend doing this before deferring, as unexpected reductions in other payments could cancel out any gains from the increased pension.

What Happens If You Die While Your Pension Is Deferred?

One of the more sensitive but important questions I came across while researching this topic was: If you defer your State Pension and die, what happens to it?

The answer depends on whether you started claiming your pension before your death and how long you deferred.

If you deferred and passed away before claiming, your estate or surviving partner may inherit part or all of the deferred amount, depending on the rules and your deferral period.

If you deferred for:

- More than 12 months: A lump sum or regular extra payments can be inherited.

- Between 5 weeks and 12 months: Only increased regular payments can be inherited.

- Less than 5 weeks: The deferred amount becomes part of the deceased’s estate.

To inherit a deferred State Pension, your partner must meet certain criteria:

- They must have been married or in a civil partnership with you when you died

- You must have reached State Pension age before 6 April 2016

- Your partner must not have remarried before their own State Pension age

In cases where the deceased was already receiving extra pension payments, the surviving partner will usually inherit them as additional regular payments.

This is one of those areas where the rules are clear but often misunderstood.

A government pensions advisor I spoke with recently put it like this:

“People assume that all deferred pension is lost on death. That’s not true. There are systems in place to ensure some or all of it can be passed on, depending on eligibility.”

I think more awareness around this would reassure many people who are hesitant to defer because of health or age-related concerns.

Can You Defer More Than Once?

You can technically defer more than once, but the rules are complex. For example, if you start claiming your pension and later decide to stop it again (known as suspending), you can build up new deferred amounts. However, only one lump sum payment is allowed under current rules.

You also cannot go back and forth repeatedly. Each deferral after claiming must meet the minimum time requirements, and administrative approval is needed.

In my case, I looked into this when considering part-time work post-retirement. While I ultimately chose not to defer a second time, I found it helpful to know that flexibility exists, especially for those with changing circumstances.

What Are The Risks Of Deferring?

While deferring can be beneficial in the long run, it’s not without risk. Here are some potential downsides to consider:

- You may not live long enough to benefit from the increased payments

- Tax implications if the extra income pushes you into a higher tax band

- Loss of access to other benefits if deferral increases your overall income

- You might forget to claim, especially after years of deferral

- Interest is not added to deferred payments under the new system

The break-even point, the time it takes for increased payments to match what you gave up by deferring is usually 15 years or more. That means if you defer one year of pension (£11,973) and receive £13.35 more per week, it would take over 15 years to recoup what you missed.

From my own perspective, I found this one of the most important calculations. I had to ask myself honestly: Am I in good enough health to make this worthwhile? For some people, especially those with shorter life expectancies or who need money now, deferring might not be the best option.

What If You Move Abroad Or Live Outside The UK?

If you live abroad, the rules vary depending on the country. If you move to a country in the EEA, Switzerland, or one that has a social security agreement with the UK, your deferred State Pension will work just like in the UK.

If you move to Canada or New Zealand, however, different rules apply. Your extra pension payment will be calculated based on the value at the time you reached State Pension age or the date you moved abroad, whichever is later. It won’t increase over time.

To get accurate information about how your pension will be treated, you should contact the International Pension Centre.

Conclusion

Deferring your State Pension can be a smart financial decision if you’re in good health, don’t need the income immediately, and want to boost your future payments. However, it’s not suitable for everyone, especially if you rely on benefits or need flexibility.

Understanding the rules, benefits, and risks is essential before making your choice. From my own experience and professional insights, careful planning is key to making deferral work in your favour and ensuring long-term financial stability in retirement.

FAQs About Deferring Your State Pension

What’s the minimum time I need to defer to receive extra pension payments?

You must defer for at least 9 weeks under the new State Pension or 5 weeks under the basic State Pension to qualify for increased weekly payments.

Will I pay tax on the extra income from deferring my pension?

Yes, any extra income you receive from deferring, whether as weekly payments or a lump sum, is taxable and could push you into a higher tax bracket.

Can I defer my State Pension if I’m still working full-time?

Yes, you can defer your pension even if you’re working. It might benefit you more if your current income means you don’t need the pension right away.

What happens if I forget to claim my deferred pension?

Your pension continues to defer automatically until you claim. However, you won’t receive back payments beyond 12 months unless you request it in that timeframe (for those under the new system).

Is it better to take a lump sum or increased weekly payments?

This depends on your age, health, and income needs. Lump sums offer immediate cash, while increased payments may be better long-term if you live longer.

Will deferring affect my Winter Fuel Payment?

If you defer your pension, you must manually claim the Winter Fuel Payment, but only once. It won’t be automatic like it is for those receiving the pension.

Can Deferring My Pension Affect My Spouse’s Entitlement Later?

Yes, especially if you die before claiming. Your spouse or civil partner may inherit some or all of your deferred pension if eligibility criteria are met, particularly under the old pension rules.

Leave a Reply