Up to 75% of eligible UK pensioners are missing out on over £1,300 a year in unclaimed government benefits—a shocking oversight revealed by recent research from Just Group.

These include Pension Credit, Council Tax Reduction, and other income-related support designed to ease the burden on low-income retirees. Yet the majority of eligible individuals either don’t know they qualify or find the system too complex to navigate.

Key points covered in this article:

- Pension Credit and Council Tax Reduction most commonly unclaimed

- 42% of pensioner homeowners are eligible, but only 26% claim

- Lack of awareness and misinformation are major barriers

- Real-life examples show losses of up to £5,877 per year

Why Are So Many Pensioners Missing Out on Benefits They Deserve?

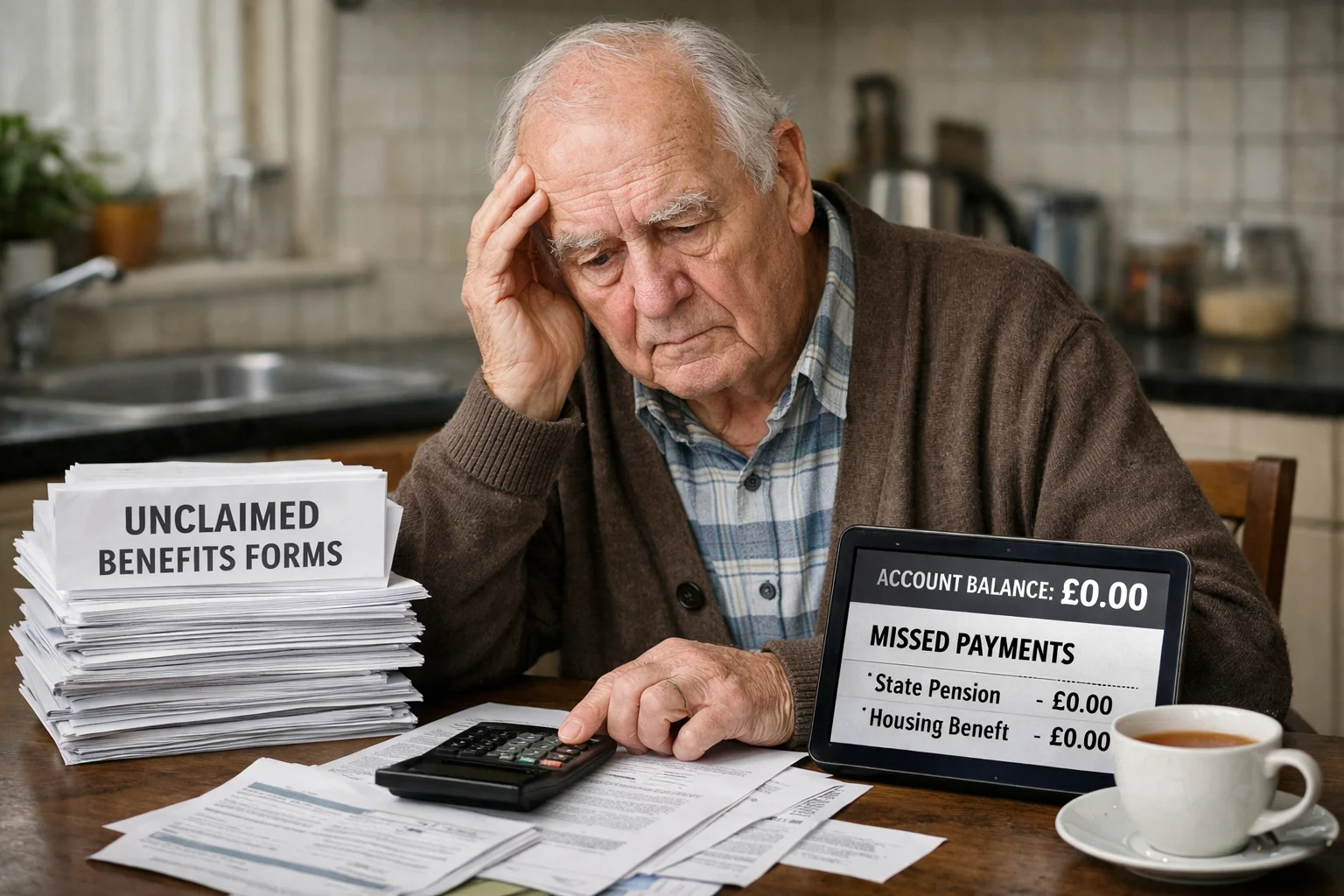

There is an urgent and growing issue in the UK’s ageing population: thousands of pensioners are going without money they are legally entitled to.

According to research from retirement specialists Just Group, a staggering 75% of eligible pensioners are failing to claim key benefits. This isn’t a small matter of a few pounds each month.

The average unclaimed amount per year is £1,339, which could make a significant difference for many people trying to manage rising living costs on a fixed income.

When I first encountered these figures, I was surprised by how high the non-claim rate really is. It’s not simply an oversight or a matter of complicated eligibility rules.

It appears to be a systemic issue, driven largely by a lack of information and outreach.

Many pensioners don’t realise that benefits such as Pension Credit, Council Tax Reduction, and Universal Credit can apply to them, especially if they own their home or have some savings.

The research suggests that more than four in ten pensioner homeowners could be eligible for one or more of these benefits.

Yet nearly three quarters of them are not claiming any of them. These are not pensioners with substantial savings or wealth.

In fact, the data indicates that most of these households are on low incomes and are potentially struggling with the ongoing cost of living crisis.

The most common reasons for not claiming include:

- Lack of awareness that the benefits exist

- Uncertainty about eligibility, especially among homeowners

- Complexity or perceived difficulty in the application process

- Mistrust in government systems or fears about losing independence

As someone who has written about financial topics before, this particular issue struck me because it is a clear case of the system letting people down.

These benefits are meant to be safety nets, but they are ineffective if the people who need them don’t know they exist or feel discouraged from applying.

What Types of Benefits Are Pensioners Failing to Claim?

Many of the unclaimed benefits are core financial supports designed to help older adults maintain a basic standard of living in retirement. These are not niche schemes or small grants.

They are long-established entitlements that were created to ensure people in later life are not left behind.

Pension Credit: Guarantee and Savings Credit

Pension Credit is a means-tested benefit split into two parts: Guarantee Credit and Savings Credit. Guarantee Credit tops up a pensioner’s weekly income to a minimum threshold, which is currently set by the government.

Savings Credit, on the other hand, rewards those who have modest savings or private pension income, even if they do not qualify for Guarantee Credit.

Despite the significance of this benefit, it remains heavily underclaimed. The Department for Work and Pensions (DWP) has previously acknowledged that nearly one million pensioners are eligible but do not receive Pension Credit.

This figure is deeply concerning because Pension Credit acts as a gateway to other important benefits. These include:

- Free TV licences for those over 75

- Housing Benefit to help with rent

- Cold Weather Payments and Winter Fuel Payments

- Help with NHS dental treatment, glasses and travel to hospital

The gateway nature of Pension Credit cannot be overstated. Failing to claim it not only means missing out on the £1,339 annual average but also the many additional benefits that come with it. One missed claim can affect several areas of financial support.

Council Tax Reduction and Universal Credit

Council Tax Reduction is another benefit that is severely underutilised among pensioners. Based on the findings by Just Group, only 24% of eligible pensioners claim this support.

This is despite the fact that a successful claim often results in more than £1,000 saved per year on council tax bills.

Universal Credit is more commonly associated with working-age individuals, but some pensioners, especially those with a younger partner or specific circumstances, may still qualify.

Yet this too is often overlooked due to the stigma or confusion surrounding the term “Universal Credit”.

To help clarify the scale of this issue, here is a comparison of some of the key unclaimed benefits:

| Benefit | Eligibility Among Pensioners | Claim Rate | Average Value (Annual) |

| Pension Credit | High (up to 1 million eligible) | Approx. 33% | £1,339 |

| Council Tax Reduction | 42% of pensioner homeowners | 24% | £1,000+ |

| Universal Credit (retired) | Lower eligibility | 18% | £900 |

How Does This Affect Low-Income Pensioner Homeowners in the UK?

One of the most shocking aspects of the data is how many homeowners are affected. Just Group’s findings reveal that 42% of pensioner homeowners are eligible for at least one benefit, yet 74% of them don’t claim.

These are not wealthy retirees many of them are on low incomes and struggling to manage rising living costs.

To put it into perspective: around 62% of eligible pensioners miss out on at least one key benefit, 12% miss two, and 5% miss three. That’s not a small margin it’s a systemic failure.

One particularly telling insight came from David Cooper, director at Just Group, who put it plainly:

“Our survey once again reveals what appears to be an epidemic of pensioner homeowners missing out on income they are entitled to claim… These are low-income pensioner households likely to be struggling with the cost-of-living crisis.”

As someone who has researched this issue, I share that concern. In my view, the biggest tragedy is not just the missed money, but the stress and hardship pensioners endure without knowing help is available.

Can a Quick Eligibility Check Really Unlock Thousands of Pounds?

It might sound too good to be true, but in this case, it’s a reality. A five-minute eligibility check could unlock thousands in financial assistance for many pensioners.

The DWP offers an online Pension Credit calculator, which is designed to make the process as easy as possible. I personally tried the tool during my research and found it to be straightforward.

It asks for basic details such as age, income, savings, and living arrangements. Within minutes, it provides a clear indication of whether you might be eligible and what you might receive.

While the technology is user-friendly, I realise not everyone is comfortable navigating government websites or online forms.

That’s where support from family members, carers, or local organisations like Age UK and Citizens Advice can make a big difference.

There is also the issue of incorrect payments. Just Group found that 14% of pensioners who were receiving benefits were actually being underpaid, missing out on over £1,100 annually.

In one case, a single claimant was found to be missing £113 per week, which added up to more than £5,800 a year.

These errors and oversights can go unnoticed for years unless a full benefit check is carried out. It is not enough to assume that the system is working perfectly.

Pensioners and their families need to be proactive in reviewing what they receive and what they may still be entitled to.

How Can the Government Improve Pension Benefit Awareness?

One of the most pressing questions to arise from these findings is how we can close the awareness gap. The government has a responsibility to ensure that people understand the benefits available to them, particularly those who are most vulnerable.

The current process places too much responsibility on individuals to self-identify as eligible and then navigate a sometimes complex claims process. While the online tools are a good start, they are not enough.

In my opinion, several improvements could be made:

- Include benefit entitlement checks during the State Pension application process

- Send annual reminder letters to all pensioners who may be eligible

- Partner with GP surgeries, pharmacies, and community centres to distribute information

- Train housing officers and council staff to provide benefit information during routine interactions

These simple interventions could ensure that the information reaches those who need it most.

The lack of communication is not just a technical issue. It reflects deeper problems in how we value our ageing population. Ensuring that pensioners receive what they’re due should not require a campaign or investigation—it should be a given.

What Should You Do If You Suspect You’re Missing Out?

If you think you might be eligible for any of the benefits mentioned in this article, there are clear steps you can take to check and claim. Even if you’re unsure or think you have too much income or savings, it’s worth verifying your status.

Here are some practical steps to follow:

- Visit the GOV.UK Pension Credit Calculator to check eligibility

- Contact your local council about Council Tax Reduction options

- Speak to a Citizens Advice advisor for help with benefit applications

- Talk to your bank or building society about financial guidance for pensioners

- Review all correspondence from the DWP to identify any potential benefit offers or reminders

Getting started is often the hardest part, but once the process begins, many find it more manageable than they feared. Most importantly, this isn’t about asking for favours. These are rights that have been earned through a lifetime of work and contribution.

What Does a Real-Life Example of a Missed Benefit Look Like?

During my research into pensioner benefits and unclaimed entitlements, I came across a case that truly highlights how serious this issue can be—not just in theory, but in day-to-day life.

One pensioner, identified through a benefit review conducted by Just Group, was found to be missing out on £113.03 every single week. That’s over £5,877 a year in unclaimed financial support.

This person was eligible for Pension Credit, yet had never applied because they believed, wrongly, that owning their home meant they wouldn’t qualify.

It wasn’t until a family member stepped in and encouraged a full benefit check that the issue was discovered.

The additional money they now receive has gone toward essential living costs energy bills, food, and transportation and it’s even allowed them to save a little each month for emergencies.

It’s had a transformational impact on their quality of life, all from a benefit that should have been claimed years earlier.

What struck me most was how easily this could have remained undiscovered.

No official letters, no phone calls from the government. Without someone prompting a check, that money would have continued to go unclaimed indefinitely.

This isn’t a rare case either. Just Group’s research shows that around 14% of those already claiming benefits are receiving too little, often by hundreds or even thousands of pounds per year.

That makes it all the more important for pensioners and their families to be proactive. Even if someone is already receiving some support, it doesn’t mean they’re getting the full amount they’re entitled to.

Stories like this serve as a wake-up call. They prove that the problem isn’t just statistical it’s personal. And it can be fixed with just a little more awareness and support.

Conclusion

Thousands of pensioners across the UK are unknowingly missing out on vital income each year.

With benefits like Pension Credit and Council Tax Reduction often left unclaimed, it’s clear that more awareness and guidance are urgently needed.

A simple eligibility check can unlock life-changing financial support.

No one should struggle in retirement when help is available. If you or someone you know could benefit, take a few minutes today it could make a lasting difference.

FAQs About Unclaimed Pensioner Benefits in the UK

How do I know if I’m eligible for Pension Credit?

You can use the DWP’s online Pension Credit calculator or speak to Citizens Advice for help. Eligibility is based on your income and savings.

Why aren’t pensioners claiming benefits they’re entitled to?

Many are unaware they qualify, assume owning a home disqualifies them, or find the process confusing or intimidating.

Are these benefits only for renters?

No. Many homeowners on low incomes qualify for benefits like Pension Credit and Council Tax Reduction.

What other benefits come with Pension Credit?

You may also get free TV licences, cold weather payments, dental treatment help, and housing benefit.

What is the average amount unclaimed by eligible pensioners?

On average, pensioners miss out on around £1,339 a year — and in some cases, significantly more.

Can claiming Pension Credit affect my other benefits?

Yes, but often positively. Pension Credit can unlock eligibility for additional help it acts as a gateway benefit.

Where can I get help applying for these benefits?

Citizens Advice, Age UK, and your local council can help. You can also apply online via GOV.UK.

Leave a Reply