Many individuals across the UK rely on Personal Independence Payment (PIP) as a financial lifeline to support their daily needs due to long-term health conditions or disabilities.

But what happens when a claim is approved months after it was first submitted? Can these payments be backdated, and if so, how do you ensure you’re receiving the money you’re owed?

In this guide, we’ll break down everything about backdated PIP payments. We’ll explore what PIP is, how it works, the eligibility criteria, how far back payments can go, and how you can calculate what you’re owed.

This blog is designed to help you understand your entitlements in a simple, clear, and practical way, because when you’re managing a health condition, the last thing you need is more confusion about your finances.

What Are PIP Payments?

Personal Independence Payment (PIP) is a UK government benefit designed to help people aged 16 or over who are living with long-term physical or mental health conditions. It’s intended to assist with the extra costs that can come with these conditions, regardless of your employment status, savings, or any other income or benefits you receive.

PIP is made up of two components:

Daily Living Component

This part is for people who need help with everyday tasks such as:

- Preparing and eating food

- Managing medication

- Bathing and personal hygiene

- Dressing

- Handling money or making budgeting decisions

Mobility Component

You may receive this part if you need help moving around, including:

- Planning journeys

- Walking or navigating safely

- Getting in or out of your home

The amount awarded depends on the severity of your condition and how it affects your ability to perform tasks safely and regularly. You might get one or both components, and either at a standard or enhanced rate.

How Assessments Work?

Your claim is assessed by the Department for Work and Pensions (DWP), who evaluate how your condition affects your daily life and mobility. The assessment includes how long a task takes you, whether you can do it safely, and if you need help, either from a person or with assistive devices.

If your situation changes, your payments can be reassessed. This ensures you continue to receive the appropriate level of support.

How Does PIP Work and Who Qualifies?

To qualify for PIP in 2025, you must meet specific criteria. These include:

- Being aged 16 or older and under State Pension age

- Having a long-term physical or mental health condition or disability

- Experiencing difficulty with daily tasks or mobility

- Expecting these difficulties to last at least 12 months from when they started

PIP does not depend on your income, savings, or employment status, making it accessible to a wide range of people in need of support.

Daily Living and Mobility Activities

The DWP will assess your need based on:

- The frequency and severity of your difficulties

- Whether you can perform tasks unaided

- Whether you need assistive technology or human assistance

Special Considerations

If you are terminally ill or nearing the end of life, your application will be fast-tracked. In such cases, you’ll automatically qualify for the daily living component and potentially the mobility component depending on your situation.

For individuals moving between Scotland and the rest of the UK, Adult Disability Payment (ADP) applies in Scotland, while PIP continues in England and Wales. Transferring benefits involves notifying the appropriate departments and reapplying if required.

When Do PIP Payments Start and How Are They Paid?

Once your claim is approved, you’ll receive a decision letter from the DWP. This outlines:

- Your entitlement amount

- The start date for your payments

- Whether your payments include backdated arrears

- The review date of your claim

How Payments Are Made?

PIP is usually paid every four weeks directly into your bank or building society account. In cases where you do not have an account, the Payment Exception Service is available.

Lump Sum vs Installments

If you are entitled to a large backdated amount, the DWP may offer to pay this in installments. While some prefer lump sums, choosing installments can help with financial management if you struggle to budget larger payments.

Special Cases: Appointees and Motability

If you’re an appointee handling someone else’s claim, payments go directly to your account. For individuals on the Motability Scheme, part or all of the mobility component may be paid directly to the provider managing the lease of a vehicle or mobility aid.

Can PIP Payments Be Backdated Automatically?

Yes, PIP payments are often automatically backdated to the date you first contacted the DWP to start your claim. This is crucial, as many assume that payments only begin from the date the decision is made.

Backdated payments account for the lengthy time it can take to assess a claim, including document processing and possible health assessments.

Common Scenarios for Backdating

- If you called the DWP in February but received a decision in October, your payments may be backdated to February

- If your claim was delayed due to needing a health assessment, the same principle applies, the backdate goes to your initial point of contact

Backdating happens without requiring a separate request. It is calculated automatically and added to your first payment.

How Far Back Can PIP Payments Be Backdated?

PIP backdating is generally tied to the date you made your initial claim or when your three-month qualifying period ends, whichever comes later.

This means the maximum standard backdating applies from:

- The date you first called to request the claim pack

- Or the end of your three-month qualifying period for new conditions

No “Three-Month Backdating” Myth

A common misconception is that PIP is automatically backdated by three months for everyone. This is not true. The three-month period is only relevant if your condition did not exist prior to the date you applied. Otherwise, the backdated period starts from your initial claim date.

In rare situations, PIP may be backdated further due to legal rulings or policy updates. For example, after the MM Supreme Court judgment, some people received back payments for periods where they were previously underpaid.

Do You Need to Request Backdated PIP Payments Separately?

No, you do not need to request backdated PIP payments separately. The Department for Work and Pensions will automatically assess and calculate your entitlement, including any arrears due.

This is part of the standard award process, meaning:

- You don’t need to fill in extra forms

- You won’t need to send reminders

- The arrears will usually be included in your first payment

However, if you believe the amount is incorrect or that your payments have not been properly backdated, you can request a Mandatory Reconsideration or appeal the decision.

How Much Could You Receive in PIP Backdated Payments?

The amount of backdated payment depends on the component(s) awarded, the rate, and the length of time between your application and the decision.

Here’s a breakdown of weekly rates from April 2025:

| Component | Standard Rate | Enhanced Rate |

|---|---|---|

| Daily Living | £73.90 | £110.40 |

| Mobility | £29.20 | £77.05 |

Example Calculation

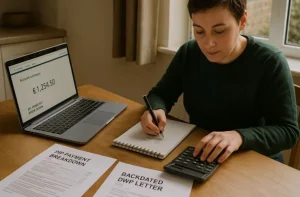

If your PIP decision took four months and you were awarded the standard daily living component, your backdated payment would be:

- £73.90 × 4 weeks × 4 months = £1,182.40

If you received both standard daily living and standard mobility:

- (£73.90 + £29.20) × 4 weeks × 4 months = £1,772.40

These figures can vary slightly depending on whether your payments cross over into a new financial year with updated rates.

How to Calculate Backdated PIP Payments? – With Example

To help you better understand how much you might receive, here’s a table that simplifies the calculation process.

Step-by-Step

| Component | Weekly Rate | Number of Weeks | Total |

|---|---|---|---|

| Daily Living (Standard) | £73.90 | 16 | £1,182.40 |

| Mobility (Standard) | £29.20 | 16 | £467.20 |

| Total Backdated Payment | £1,649.60 |

This assumes a 16-week delay between claim and approval. If you qualify for enhanced rates or both components, the amount will be higher.

What Should You Do If You Haven’t Received Your Backdated PIP?

If your first PIP payment didn’t include any backdated amount and you believe you’re entitled to it, take the following steps:

What to Do?

- Double-check the date you made your initial claim

- Review your decision letter to see what dates are listed

- Contact the PIP helpline and provide your National Insurance number

- If needed, request a Mandatory Reconsideration within one month

It’s also important to speak with a welfare advisor, such as those at Citizens Advice or a local disability rights organisation, for guidance.

Can You Appeal a Decision on PIP Backdated Payments?

Yes, if you disagree with your payment amount or dates, you can challenge it through the following steps:

Step-by-Step Process

- Mandatory Reconsideration: Request this within one month of the decision. It allows the DWP to review your claim again.

- Appeal to Tribunal: If the reconsideration result is still unsatisfactory, you can escalate the issue to an independent tribunal.

This process ensures you can dispute not just your award rate but also the amount and period of any backdated payments.

What is the Real-Time Example of a Backdated PIP Claim in the UK?

Let’s consider a real case to illustrate how backdated payments work in reality.

Case Example: Sarah from Manchester

Sarah contacted the DWP to initiate a PIP claim in February 2025 due to mobility issues and severe arthritis. She completed her form promptly, but due to workload backlogs, her health assessment was not scheduled until June.

Her claim was approved in July, and she was awarded the standard rate for both daily living and mobility components.

The DWP confirmed that her payments would be backdated to February, not July. Her total backdated payment for the five-month period came to £2,216, which was paid as a lump sum into her bank account alongside her regular ongoing payments.

This case shows the importance of the initial application date in determining your arrears.

Why PIP Payments Backdated Can Be Life-Changing for Claimants?

For many claimants, receiving backdated PIP payments is not just a financial technicality, it’s a lifeline.

Why It Matters?

- Covers months of additional expenses that went unpaid

- Allows claimants to purchase essential items such as mobility aids

- Helps reduce debt accumulated while waiting for a decision

- Offers emotional and financial relief after a stressful waiting period

In many cases, individuals use the arrears to modify their homes for accessibility, fund transport costs, or hire care assistants. It can be the turning point in managing their health condition with dignity.

Conclusion

Backdated PIP payments are designed to ensure that claimants receive the support they’re entitled to from the moment they become eligible, not just from when a decision is made.

Understanding your rights, keeping good records, and seeking help if you suspect a miscalculation can make all the difference.

If you’re in the middle of a PIP claim or recently received a decision, always check that the payment period aligns with the date you applied. And remember, you don’t need to accept a decision if something doesn’t feel right, there are clear steps to challenge and appeal.

The system is designed to support you. Knowing how it works gives you the confidence to make sure you receive every penny you’re entitled to.

FAQs About PIP Backdated Payments

Will my first PIP payment be backdated to when I applied?

Yes, if your claim is approved, it will usually be backdated to the date you first contacted the DWP or started the application process.

Is PIP paid in arrears or in advance?

PIP is paid in arrears, meaning it covers the previous four weeks of entitlement.

How long after my PIP decision will I receive backdated payments?

Most claimants receive their backdated payment within two weeks of the decision letter, but it can take longer in some cases.

Who is eligible for PIP backdated payments?

Anyone who is awarded PIP after a successful claim or appeal, where there was a delay between application and decision, is usually eligible.

Can PIP ever be backdated further than my claim date?

Only in exceptional cases such as DWP reviews due to court rulings or legal changes in eligibility definitions.

Why haven’t I received my backdated PIP payment yet?

It could be due to processing delays, incomplete paperwork, or bank verification. Contact the PIP helpline if it’s been more than three weeks.

Will I get more backdated money if my award increases after an appeal?

Yes, if your award amount is increased after an appeal, you’ll receive the difference in arrears backdated to the original decision.

Are PIP backdated payments taxable or do they affect other benefits?

No, they are not taxable and don’t affect most other benefits. However, they may increase entitlement to related benefits like Carer’s Allowance.

Leave a Reply