Postgraduate education in the UK is increasingly seen as a necessary step towards career progression or academic specialisation.

However, one of the most pressing questions for prospective Master’s students is: why is there no maintenance loan for Masters like there is for undergraduate students?

While undergraduate students in England benefit from separate tuition fee and maintenance loans, Master’s students are offered a single, combined Postgraduate Master’s Loan. This has left many wondering why maintenance support isn’t provided as a distinct financial stream.

In this article, we will explore the reasoning behind this funding structure, examine how it works in practice, compare it across the UK, and identify alternative sources of support available to Master’s students.

What Is a No Maintenance Loan?

In undergraduate education, a maintenance loan is a government-provided fund intended to cover living costs such as rent, food, travel, and course materials. This is paid directly to the student in regular instalments throughout the academic year, alongside a separate tuition fee loan paid to the university.

At the postgraduate level, particularly in England, there is no separate maintenance loan. Instead, students receive a single “one-pot” loan, the Postgraduate Master’s Loan, which is designed to cover both tuition fees and living expenses.

The amount is transferred directly to the student, leaving them responsible for allocating the funds appropriately between university fees and personal expenses.

A Different Approach from Undergraduate Funding

This shift in funding structure reflects a fundamental difference in how postgraduate education is treated in the UK. Postgraduate loans are non-means-tested, meaning all eligible students receive the same maximum amount regardless of their financial background.

This model is rooted in the assumption that Master’s students are more financially independent and better positioned to manage their finances than undergraduates.

Why Is There No Separate Maintenance Loan for Master’s Degrees in England?

The decision to consolidate tuition and maintenance support into one loan for postgraduate students was deliberate. There are several reasons behind this approach, which have been publicly acknowledged by government bodies and education finance organisations.

Government’s Rationale – Financial Maturity and Responsibility

The UK Government considers postgraduate students to be generally older, more experienced, and financially mature. The logic follows that these individuals should be capable of budgeting a single loan amount to cover their varied needs during their course of study.

This perception informs policy decisions around postgraduate funding and avoids the complexities involved in administering two separate loans.

Real-Time Example – Emily, a 27-Year-Old Master’s Student in Manchester:

Emily left full-time employment to pursue an MSc in Data Analytics at a university in Manchester. She received the full Postgraduate Master’s Loan of £12,471 but found that after paying £9,000 in tuition, she had only £3,471 left for living expenses.

Since her rent alone was £650 per month, the remaining loan amount barely covered five months of rent, let alone utilities, travel, or groceries. Emily works part-time at a tech startup and lives in a shared flat, but without a separate maintenance loan, she’s constantly balancing work with studies just to meet basic needs.

Emily’s case illustrates the challenge the one-pot loan system creates, while she is older and more financially aware, the structure still places pressure on her to find additional income sources to remain afloat during her studies.

Administrative Simplicity and Cost Control

Offering a combined postgraduate loan ensures administrative simplicity and better cost control. It streamlines both the application and repayment process, reducing the workload for Student Finance England and improving efficiency.

Key reasons include:

- Lower administrative overhead due to a single loan structure.

- Easier management of public spending and repayment tracking.

Preventing additional borrowing per student, which could otherwise raise the government’s education budget at a time of growing financial scrutiny in higher education.

Comparisons with Undergraduate Student Support

At undergraduate level, education is typically a student’s first full-time experience outside the family home. Maintenance loans aim to support this transition.

Postgraduates, in contrast, are often returning to education from the workplace, sometimes on a part-time basis, and are more likely to have access to other financial resources.

How Does Postgraduate Student Funding Work in the UK?

In England, the Postgraduate Master’s Loan is offered to eligible students to help with the cost of a Master’s degree.

For the 2024/25 academic year, students can apply for up to £12,471 in total, whether studying full-time or part-time. This loan is paid directly to the student in three instalments throughout the academic year.

Eligibility and Application Process

To be eligible for a Postgraduate Master’s Loan, students must meet specific residency and course requirements set by Student Finance England. The loan provides flexibility, allowing students to use the funds for tuition, living costs, or other study-related expenses.

Eligibility Criteria:

- Must be a UK national or have settled status.

- Normally reside in England.

- Enrolled in an approved Master’s programme at any UK university, including distance learning.

Application Details:

- Applications must be submitted within nine months of the start of the final academic year.

- The loan is non-means-tested, meaning household income doesn’t affect eligibility.

- Funds are not split between tuition and maintenance, students manage how to use them.

Overall, this structure gives students greater control over how they finance their studies, though it also requires careful budgeting and planning.

What Are the Differences in Postgraduate Funding Across the UK?

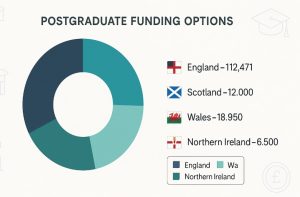

While England offers a flat-rate, one-pot loan for postgraduate studies, devolved governments in Scotland, Wales, and Northern Ireland take different approaches.

Comparative Table of Postgraduate Funding Across UK Nations (2024/25)

| Country | Tuition Loan | Maintenance Support | Total Support Available |

|---|---|---|---|

| England | £12,471 (combined) | None (one-pot system) | £12,471 |

| Wales | £6,885 (loan) + £1,000 (grant) | £11,065 (grant + loan) | £18,950 |

| Scotland | £7,000 (tuition loan) | £6,900 (maintenance loan) | £13,900 |

| Northern Ireland | £6,500 (tuition loan only) | None | £6,500 |

Wales stands out by offering the most generous postgraduate support, combining loans and non-repayable grants to help cover both tuition and living costs. Scotland offers separate loans for tuition and maintenance, while Northern Ireland provides tuition fee support only.

What Can the Postgraduate Master’s Loan Be Used For?

Since the postgraduate loan is a single payment, students have complete discretion over how to use it. However, the fixed amount means careful budgeting is essential, especially in high-cost areas such as London.

Common Expenses Covered by the Loan

- Tuition fees (ranging from £4,000–£12,000 depending on the university)

- Accommodation (halls or private rental)

- Daily living expenses (food, utilities, transport)

- Books, equipment, and study materials

Table: Typical Master’s Student Costs vs. Loan Value (London, 2024/25)

| Expense Category | Estimated Cost | Covered by Loan? |

|---|---|---|

| Tuition Fees | £9,000 | Partially |

| Rent (12 months) | £8,400 (£700/month) | No |

| Living Expenses | £4,000 | Partially |

| Total | £21,400 | £12,471 Max Loan |

Even with frugal living, the loan is often insufficient to cover all essential costs. Many students turn to supplementary sources for financial support.

Are There Any Alternative Funding Options Available for Master’s Students?

Yes, there are several additional resources available for students who find the postgraduate loan insufficient.

Scholarships and Bursaries

Many UK universities offer competitive scholarships and bursaries for domestic and international postgraduates. These may be merit-based, need-based, or linked to a specific field of study. Organisations like Postgrad Solutions also offer bursaries worth up to £2,000 for eligible students.

Real-Time Example – Ahmed, a Master’s Student in London Receiving a University Bursary:

Ahmed enrolled in an MA in International Relations at a London university. With tuition set at £10,800 and rent in London costing nearly £900 per month, Ahmed knew the £12,471 postgraduate loan wouldn’t cover everything.

Fortunately, he successfully applied for a university hardship bursary of £2,500 targeted at students from low-income households. This additional funding allowed him to reduce his part-time work hours and focus more on his dissertation.

Ahmed’s experience shows how vital supplementary funding options can be, particularly for students in expensive cities or from disadvantaged backgrounds.

Charities, Foundations, and Trusts

Non-profit organisations such as the Leverhulme Trust and The Royal Society provide funding to students in specific disciplines or underrepresented groups. These sources are often overlooked but can provide substantial support for tuition and living costs.

Employer Sponsorships and Part-Time Work

Students currently employed or taking a work-relevant course (e.g., an MBA) may be able to receive sponsorship from their employer. Additionally, many Master’s students work part-time in roles that offer flexible schedules compatible with study commitments.

How Are Repayments Managed for the Postgraduate Master’s Loan?

Repayment terms for postgraduate loans are more flexible than many realise. You won’t start repaying your loan until the April after you complete your course and are earning over £21,000 per year.

- Repayment Rate: 6% of income over £21,000

- Interest Rate: RPI + up to 3%, depending on income

- Write-Off Period: Any outstanding balance is written off after 30 years

If you’re already repaying an undergraduate loan, payments for both loans will be made simultaneously, with separate percentages deducted from your income.

Is There Ongoing Discussion or Proposed Reform Around Postgraduate Maintenance Loans?

Yes. Several student unions, university think tanks, and education policy groups have argued that the current postgraduate funding model is inadequate for many students, especially those from low-income backgrounds.

While there is no current proposal from the UK Government to introduce a separate maintenance loan for Master’s degrees, pressure is mounting.

Reports from bodies like Universities UK and the Sutton Trust suggest that insufficient financial support may deter disadvantaged students from pursuing postgraduate education.

What Should Students Consider Before Applying for a Master’s Without Maintenance Support?

Taking on a postgraduate degree without a dedicated maintenance loan means students must make practical, informed decisions before committing to a course.

Key Considerations:

- Total Cost of Attendance: Consider tuition, rent, and living expenses over 12–18 months

- Income Sources: Do you have savings, part-time job prospects, or family support?

- Return on Investment: Will the degree lead to better career opportunities or higher earning potential?

- Study Format: Full-time, part-time, or distance learning, each has financial implications

Being proactive in budgeting and researching alternative funding routes is essential to avoid financial strain during your studies.

Conclusion

Although there is no separate maintenance loan for Master’s degrees in the UK, the Postgraduate Master’s Loan offers a flexible way to cover both tuition and living costs. However, the one-pot system presents challenges for many students, particularly those without access to additional resources.

Understanding the structure, managing funds wisely, and exploring supplementary funding options can make postgraduate study more accessible and sustainable.

With increasing discussion around funding reforms, it remains crucial for prospective students to stay informed and prepared as they plan their academic futures.

Frequently Asked Questions

Can international students access the UK postgraduate master’s loan?

Only students with settled or pre-settled status in the UK are eligible. Most international students must seek external or university-based funding.

Why is the postgraduate loan amount lower than expected living costs?

The loan is designed as a contribution, not full coverage. The government assumes students will access other sources like savings, work, or scholarships4.

Is the postgraduate loan enough to live on while studying full time?

For many, especially in cities like London, the loan will not be sufficient. Budgeting and securing additional support is often necessary.

Are there postgraduate courses that offer additional financial help?

Yes. Some universities and departments offer course-specific scholarships, especially for research-based or industry-aligned programmes.

What happens if your course fees are higher than your loan amount?

You must fund the difference yourself or apply for supplementary financial support such as scholarships or bursaries.

Can you get a loan if you’ve already had student finance for an undergraduate degree?

Yes. Undergraduate and postgraduate student loans are treated separately, and prior borrowing does not affect eligibility.

How many instalments is the postgraduate loan paid in?

The loan is paid directly to the student in three equal instalments throughout the academic year.

Leave a Reply