Understanding how much you can earn before paying tax in the UK is essential for anyone working, freelancing, or running a business.

The UK income tax system operates with thresholds and allowances, and knowing where you stand can help you stay compliant while managing your finances more effectively.

This guide covers everything you need to know about income tax-free limits, the Personal Allowance, tax bands, additional allowances, and how to legally reduce your tax liability in the UK during the 2025/26 tax year.

What Is the UK Personal Allowance for 2025/26?

The Personal Allowance is the amount of income an individual can earn each tax year before becoming liable to pay income tax. For the 2025/26 tax year, the standard Personal Allowance remains unchanged at £12,570 for most taxpayers in England, Wales and Northern Ireland.

This means individuals earning £12,570 or less do not pay any income tax. The Personal Allowance is applied automatically, usually via PAYE for employees or through the tax calculation in Self Assessment for those who are self-employed.

However, individuals with adjusted net income over £100,000 begin to lose their Personal Allowance. For every £2 earned over £100,000, the allowance is reduced by £1. If income reaches £125,140 or more, the entire allowance is removed, and the individual pays tax on all earnings.

How Do UK Income Tax Bands Work in the 2025/26 Tax Year?

After the Personal Allowance is deducted from your income, the remaining amount is taxed according to a series of progressive bands. These income tax bands determine how much tax is paid depending on how much income falls within each band.

The following table outlines the current income tax bands and rates for the 2025/26 tax year for individuals with the standard Personal Allowance:

| Income Tax Band | Taxable Income Range | Tax Rate |

| Personal Allowance | Up to £12,570 | 0% |

| Basic Rate | £12,571 to £50,270 | 20% |

| Higher Rate | £50,271 to £125,140 | 40% |

| Additional Rate | Over £125,140 | 45% |

The income falling within each band is taxed at the corresponding rate. These rates apply to England, Wales and Northern Ireland. Individuals residing in Scotland are subject to different tax rates and bands.

The freezing of income tax thresholds, including the Personal Allowance and tax bands, is part of the government’s fiscal policy, aimed at reducing public borrowing while gradually increasing tax receipts through fiscal drag.

What Happens If You Earn Over £100,000?

Earning above £100,000 places individuals in a specific tax scenario where their Personal Allowance is tapered, increasing the effective marginal tax rate.

For each £2 over £100,000 earned, £1 of the Personal Allowance is withdrawn. This continues until the entire Personal Allowance is removed at an income level of £125,140.

This withdrawal results in an effective tax rate of 60% on income between £100,000 and £125,140, due to:

- The removal of the tax-free allowance

- Tax being paid at the higher rate (40%) on that portion

Taxpayers in this bracket often consider pension contributions or charitable donations to bring their income below the threshold and preserve their allowance.

Are There Any Additional Tax-Free Allowances?

In addition to the standard Personal Allowance, individuals in the UK may be eligible for several additional tax-free allowances depending on their circumstances.

Blind Person’s Allowance

- An extra allowance of £3,070 is available to individuals who are registered blind or severely sight impaired.

- This is added on top of the standard Personal Allowance.

Marriage Allowance

- A person who earns less than the Personal Allowance and is married or in a civil partnership can transfer £1,260 of their unused allowance to their partner.

- This could reduce their partner’s tax bill by up to £252 per year.

Savings Interest Allowance

- Basic rate taxpayers: Up to £1,000 of savings interest is tax-free

- Higher rate taxpayers: Up to £500

- Additional rate taxpayers: £0

Dividend Allowance

- The first £500 of dividend income is tax-free. This applies even if you’re not using an ISA.

Trading and Property Income Allowances

- Up to £1,000 of income from self-employment (trading allowance) and £1,000 from property rental (property allowance) can be earned tax-free.

Eligible individuals can combine multiple allowances to reduce their overall taxable income and increase their tax efficiency.

How Is Income Tax Calculated in the UK?

Income tax is calculated by subtracting all applicable allowances from total income and then applying the appropriate tax rates to each portion of income within the tax bands.

The method of collection differs depending on employment status:

- Employees: Tax is deducted through the PAYE system, where employers automatically withhold income tax and National Insurance contributions.

- Self-employed: Must register for Self Assessment and file a tax return each year.

Example Calculation

An individual earning £35,000 annually, with the standard Personal Allowance, would calculate their tax liability as follows:

| Description | Amount |

| Total Income | £35,000 |

| Personal Allowance | £12,570 |

| Taxable Income | £22,430 |

| Tax at 20% (Basic Rate) | £4,486 |

In this example, the total income tax paid would be £4,486.

Additional deductions such as pension contributions, charitable donations, or student loan repayments can further reduce the tax owed. These deductions are factored into either the PAYE system or the Self Assessment return depending on the individual’s employment type [6].

How Much Can You Earn Before Paying National Insurance?

National Insurance Contributions (NICs) are a separate obligation from income tax. These are required for individuals over the age of 16 who are earning above specific thresholds.

NIC Thresholds and Rates (2025/26)

| NIC Type | Threshold | Rate |

|---|---|---|

| Class 1 (Employees) | £12,570 – £50,270 | 8% |

| Over £50,270 | 2% | |

| Class 2 (Self-employed) | Over £6,725 in profits | £3.45/week |

| Class 4 (Self-employed) | £12,570 – £50,270 | 9% |

| Over £50,270 | 2% |

If you are employed and earn less than £12,570, you will not pay NICs. These contributions help fund state benefits, including the State Pension, Maternity Allowance, and Jobseeker’s Allowance.

Employees can view their NIC record through their HMRC Personal Tax Account to ensure contributions are up to date and to monitor eligibility for state pension credits.

What Income Is Considered Tax-Free in the UK?

The UK tax system includes several categories of non-taxable income that do not count towards your Personal Allowance and are not included in income tax calculations.

These include:

- Individual Savings Accounts (ISAs): Income from cash or stocks and shares ISAs is tax-free

- Premium Bond winnings

- National Lottery and gambling winnings

- Scholarships and certain educational grants

- Certain welfare benefits, such as Disability Living Allowance and Attendance Allowance

- Child Benefit (Note: Subject to the High Income Child Benefit Charge if income exceeds £50,000)

Understanding which forms of income are exempt from tax can help ensure you stay within tax-free thresholds and avoid unnecessary taxation.

Can You Reduce Your Income Tax Bill Legally?

There are a variety of legal strategies that UK taxpayers can use to reduce their income tax liability.

These methods must be implemented in accordance with HMRC guidance to avoid penalties or fines.

Some commonly used strategies include:

- Pension Contributions: Contributing to a workplace pension or private pension reduces taxable income.

- Gift Aid Donations: Donations to registered charities under Gift Aid increase the value of the gift and provide tax relief for the donor.

- Marriage Allowance Transfer: Utilising unused Personal Allowance between partners can reduce overall household tax bills.

- Claiming Tax Reliefs: HMRC offers tax reliefs for professional fees, subscriptions, tools, uniforms, and certain travel expenses.

Those working from home or incurring work-related costs may also be eligible for additional reliefs. All claims must be supported by records and documentation.

It is advisable to maintain receipts and utilise HMRC’s online tools to manage and file claims accurately.

How Income Tax Applies to a UK Employee in 2025/26 With Real-Life Example?

To better understand how much you can earn before paying tax in the UK, let’s look at a practical example of a full-time employee based in England during the 2025/26 tax year.

Scenario:

Emma is employed full-time and earns a gross annual salary of £42,000. She receives no other sources of income and is not eligible for additional allowances such as Marriage Allowance or Blind Person’s Allowance.

Step-by-step tax calculation:

- Total Annual Income

£42,000 (gross salary) - Less: Personal Allowance

£12,570 (standard allowance for 2025/26) - Taxable Income

£42,000 – £12,570 = £29,430 - Apply Tax Bands

- The entire £29,430 falls into the Basic Rate band (£12,571 to £50,270)

- Basic rate tax at 20% = £5,886

So, Emma pays £5,886 in income tax for the year.

Additional Deductions

Emma would also pay National Insurance contributions, calculated separately based on thresholds and NIC classes, as discussed earlier in the blog.

Key Takeaways From this Example

- Despite earning £42,000, only the income above £12,570 is taxed.

- Since her income doesn’t exceed £50,270, she remains in the Basic Rate

- If she had made pension contributions or donated to charity under Gift Aid, her taxable income could have been reduced, resulting in lower tax.

This example demonstrates how the Personal Allowance and income tax bands apply in real life and how proper financial planning can help reduce tax liabilities within legal limits.

How Have Tax Rates Changed Over the Years?

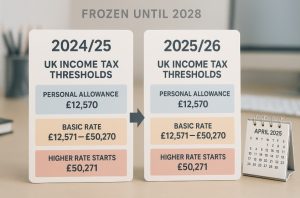

Over the past few years, the UK Government has implemented a policy of freezing income tax thresholds, including the Personal Allowance and income tax bands. Since 2021, these figures have remained static, and according to current government plans, they are set to stay frozen until 2028.

What Does This Mean in Practice?

Although tax rates themselves (such as 20%, 40%, and 45%) have not increased, freezing the thresholds effectively increases the amount of tax that many people pay over time. This is due to a concept known as fiscal drag.

Fiscal drag occurs when inflation leads to higher wages or earnings, but tax-free thresholds do not rise accordingly. As a result:

- More people start paying tax for the first time as their income exceeds the Personal Allowance

- Existing taxpayers find a larger portion of their income taxed at higher rates

- Some individuals are pushed into higher tax bands, such as the higher rate (40%) or additional rate (45%), even though their increased earnings may only match inflation

In effect, taxpayers may feel worse off in real terms, as more of their income becomes taxable, even though headline tax rates remain unchanged.

Comparison of Tax Thresholds (2024/25 and 2025/26)

The table below shows that no changes have been made to the main thresholds between the two consecutive tax years:

| Tax Year | Personal Allowance | Basic Rate Band | Higher Rate Starts |

|---|---|---|---|

| 2024/25 | £12,570 | £12,571 – £50,270 | £50,271 |

| 2025/26 | £12,570 | £12,571 – £50,270 | £50,271 |

Because these thresholds remain unchanged, individuals receiving modest annual pay increases often just to keep pace with inflation may still end up paying more tax year on year.

The Long-Term Impact

The Office for Budget Responsibility (OBR) has warned that the freeze in tax thresholds will bring millions more people into higher tax brackets by the time the freeze is lifted in 2028. This silent expansion of the tax base is a form of stealth taxation, as it increases revenue for the government without overtly raising tax rates.

In practical terms:

- A person earning £49,000 in 2023 may have paid tax mostly at the basic rate

- By 2026, a similar income adjusted for inflation could push them into the higher rate bracket, increasing their tax bill even if their purchasing power hasn’t improved

This strategy, while politically more palatable than increasing tax rates, still places a heavier burden on working and middle-income earners, particularly as the cost of living continues to rise.

The ongoing freeze, combined with rising wage inflation, is likely to remain a key factor affecting household take-home pay across the UK in the coming years .

Who Needs to File a Self-Assessment Tax Return?

Not all taxpayers need to submit a Self Assessment Tax Return, but it is mandatory under certain conditions. You must file a return if:

- You are self-employed and earned more than £1,000

- You earn income from property rentals over £2,500

- Your income is above £100,000

- You received income from overseas

- You or your partner claim Child Benefit and your income exceeds £50,000

- You are a company director or receive untaxed income

The deadline for online Self Assessment returns is 31 January following the end of the tax year. Missing the deadline results in an automatic £100 fine, with additional penalties for longer delays. Accurate reporting is essential to avoid compliance issues and penalties.

How Do Scottish Income Tax Rates Differ?

Residents of Scotland pay income tax using a different set of rates and bands for non-savings and non-dividend income.

For 2025/26, the Scottish Government applies the following bands:

- Starter Rate: 19%

- Basic Rate: 20%

- Intermediate Rate: 21%

- Higher Rate: 42%

- Top Rate: 47%

Scottish rates apply only to income such as:

- Employment income

- Self-employment profits

- Rental income

- Pensions

Savings interest and dividend income are still taxed using UK-wide rates. HMRC determines your tax band based on your primary residence.

Frequently Asked Questions

What is adjusted net income in tax calculations?

Adjusted net income is your total taxable income minus specific tax reliefs like pension contributions and Gift Aid donations. It’s used to determine reductions to your Personal Allowance.

Do students have to pay income tax in the UK?

Yes, students must pay income tax if they earn above the Personal Allowance. However, most part-time student jobs do not exceed the threshold.

Is Universal Credit taxable income?

No, Universal Credit is not subject to income tax. However, other benefits like the State Pension may be taxable.

How do pension contributions affect income tax?

Pension contributions reduce your taxable income, lowering the amount of income tax you owe. Higher-rate taxpayers receive greater relief on contributions.

What happens if I don’t pay tax owed?

Failure to pay income tax can result in penalties, interest charges, and possible legal action from HMRC.

Can I claim expenses against my income?

Yes, if you’re self-employed or incur work-related costs, you may be able to deduct allowable expenses to reduce taxable income.

How do I check how much tax I’ve paid?

You can log in to your HMRC personal tax account to view your tax records, check how much tax you’ve paid, and make corrections if needed.

Leave a Reply