If your car emits over 225g/km of CO2, you could soon be paying £735 to £790 annually in Vehicle Excise Duty (VED). From April 2026, the UK government is increasing road tax on high-emission vehicles, impacting not only luxury SUVs but also common family cars.

Here’s what you’ll learn in this guide:

- Which 10 popular cars fall into the high car tax category

- How the 2026 VED bands will affect car owners

- The environmental vs economic debate of keeping older vehicles

- First-year tax vs standard rate explained

- The impact on resale value and market demand

- Practical advice on managing or avoiding the VED tax trap

Why Are Car Tax Rates So High In The UK?

The UK’s car tax system, known as Vehicle Excise Duty (VED), is designed around environmental responsibility. At its core, the policy penalises higher-polluting vehicles in a bid to drive consumers toward cleaner alternatives. However, as rates continue to rise, the financial strain on everyday drivers is becoming increasingly difficult to ignore.

VED is applied in two stages:

- A first-year rate based on your car’s CO2 emissions when first registered

- An annual standard rate, currently £195 but rising to £200 in 2026

For vehicles emitting over 225g/km of CO2, the first-year rate is steep. These bands are about to increase once more from April 2026. Many vehicles, both modern and older, will fall into the following categories:

CO2 Emissions (g/km) First-Year VED (2024–25) First-Year VED (2026–27)

226–255 £735 £760

Over 255 £750 £790

While these charges were originally targeted at luxury SUVs and sports cars, the reality is they affect a wide range of vehicles, including family estates, MPVs and mid-size saloons. And once the first-year payment is made, the standard rate applies annually, pushing long-term ownership costs ever higher.

Owners of older vehicles face even more complex tax logic. Cars registered before March 2001 are taxed based on engine size, not emissions, at two flat rates:

Engine Size Annual VED

Under 1,549cc £229

Over 1,549cc £360

For cars registered between March 2001 and 23 March 2006, the maximum VED is capped at Band K, currently £430. But from 2006 onward, full emissions-based VED applies.

These legacy policies have resulted in bizarre inconsistencies. For example, a relatively humble Ford Mondeo V6 might face the same tax burden as a Porsche 911. For many owners, it’s no longer a matter of whether they can afford a car, but whether they can afford to keep taxing it.

The Environmental Vs Economic Dilemma

The emissions-based taxation structure is meant to promote sustainable driving habits and reduce the UK’s overall carbon footprint. But in practice, it creates a grey area where environmental responsibility clashes with economic feasibility.

Mike Berners-Lee and Duncan Clark, sustainability experts and authors of How Bad Are Bananas?, have offered a compelling argument: manufacturing a new vehicle is incredibly carbon-intensive.

They estimate that building a mid-sized new car generates around 17 tonnes of CO2e, nearly equivalent to three years’ worth of household energy use in the UK.

This challenges the assumption that buying a new low-emission vehicle is always the greener choice.

As Clark writes:

“With this in mind, unless you do very high mileage or have a real gas-guzzler, it generally makes sense to keep your old car for as long as it is reliable.”

As someone who drove a Subaru Forester 2.5 XT well into six-figure mileage, I understand the logic. Despite its relatively high VED charge, I kept the vehicle because the total carbon cost of buying a new one didn’t sit well with me.

My mechanic helped me maintain it efficiently, and I even improved the fuel economy slightly through better driving habits. The irony was that a newer, supposedly cleaner car might have cost the planet more in the long run.

It’s a situation where people must weigh not just finances, but personal ethics and lifestyle factors.

10 Popular Cars Caught in the VED Trap

1. Saab 900 Convertible – £735

The Saab 900 Convertible is one of those classic cars that has aged gracefully in design but not in taxation. A once-stylish favourite of the professional class, its soft-top appeal and solid engineering made it a premium offering in its day.

Today, this model’s emissions exceed 225g/km, pushing it into the £735 annual VED bracket.

- Market value: Often under £2,000

- CO2 emissions: Over 225g/km

- Tax status: Hits high VED band despite being a modest performer

The result is a tax cost that competes with the car’s value. Owners are often forced to choose between scrapping, selling abroad, or absorbing a cost that doesn’t reflect the car’s real-world impact. It’s another case where emissions-based policy and used car economics clash sharply.

2. Land Rover Freelander 2 i6 – £760

Launched with a premium inline-six petrol engine, the Freelander 2 i6 was meant to be a refined compact SUV option. It delivered all-wheel drive, comfort, and better on-road performance than its diesel counterparts.

Yet that 3.2-litre engine puts it firmly in the highest VED tier.

- Annual VED from 2026: £760

- CO2 emissions: Over 255g/km

- Current market value: £2,500–£3,500

Despite its capabilities, this model is now avoided by many dealers and dismissed by buyers who don’t want to be hit with such a steep annual cost. It’s one of many “normal” cars unfairly impacted by a taxation system originally designed for gas-guzzlers.

3. Audi TT 1.8T – £735

The Audi TT 1.8T remains a landmark design in early 2000s motoring. With sharp styling, turbocharged excitement, and a relatively modest footprint, it was widely popular in the UK. But emissions over 225g/km now place it in a high-tax bracket.

- Annual VED: £735

- Engine: 1.8-litre turbocharged petrol

- Ownership challenge: Higher tax than some newer, more powerful cars

This model highlights how older tech struggles under modern policy. For enthusiasts wanting a weekend car or young drivers seeking a stylish option, the tax is a major turn-off. Many end up scrapped or exported, despite still being solid performers.

4. Ford Galaxy 2.3 – £735

The Galaxy 2.3 is the quintessential family MPV. Designed for utility rather than indulgence, it delivered space, comfort, and smooth driving for large households or long-distance drivers. But that practical 2.3-litre petrol engine doesn’t sit well with modern emissions rules.

- VED bracket: £735 annually

- CO2 emissions: Over 225g/km

- Target buyers: Families now looking elsewhere due to tax burden

Unlike premium saloons or sports cars, the Galaxy isn’t a car people buy for pleasure; it’s about function. And yet, it’s penalised almost identically. That dissonance is why so many owners are abandoning them in favour of more tax-efficient models.

5. Jaguar X-Type 2.0-litre Auto – £735

Jaguar introduced the X-Type as its answer to the compact executive saloon market – sleek, refined, and competitively priced. The 2.0-litre automatic was ideal for business drivers or those wanting to experience “Jag” luxury on a budget.

But with CO2 emissions just over the threshold, it faces £735 VED from 2026.

- Used value: Often under £1,800

- Annual VED cost: Frequently outweighs insurance or repairs

- Tax issue: Outdated emissions standard overshadows reliability

As shared earlier, even a government official acknowledged that the policy unintentionally traps vehicles like this. For owners, it presents a choice: keep the car and pay a steep penalty, or cut losses and move on, often to vehicles that aren’t any cleaner in practice.

6. Subaru Forester 2.5 XT – £735

The Subaru Forester 2.5 XT is a standout among compact SUVs. Known for its rugged dependability, all-wheel-drive system, and punchy turbocharged performance, it became a favourite for countryside drivers and adventure seekers. Its combination of practicality and surprising speed made it a cult favourite in the UK.

However, its turbocharged 2.5-litre petrol engine emits more than 225g/km of CO2, putting it in the £735 VED bracket.

- VED classification: High band due to emissions

- Market value: Between £2,000 and £3,500

- Owner type: Enthusiasts or rural drivers needing reliable AWD

The frustration here is that many Foresters remain incredibly reliable, even with high mileage. As someone who owned one well into its second decade, I can say with confidence it had plenty of life left. But the tax made it unfeasible. Many owners now face the same dilemma – a great car taxed into retirement.

7. Volkswagen Golf R32 – £760

The Golf R32 was once Volkswagen’s flagship hot hatch, boasting a 3.2-litre V6 engine and the brand’s renowned 4MOTION all-wheel-drive system. It offered serious performance while maintaining the Golf’s daily usability and familiar design. To many, it’s a modern classic.

But the R32’s high-output engine emits well over 255g/km of CO2, meaning it lands in the top VED band: £760 annually from April 2026.

- Engine: 3.2L V6

- VED status: Over 255g/km puts it in highest tax category

- Resale impact: Still has enthusiast value, but limited demand due to tax

Despite its appeal, many R32s are either parked as collector items or sold abroad. Owners are hesitant to use them as daily drivers given the heavy tax burden. This is a case where a genuinely iconic car risks being priced out of regular circulation, even when mechanically sound and cherished.

8. Chrysler PT Cruiser – £735

The Chrysler PT Cruiser stands out for its retro styling – a car you either love or loathe. When launched, it offered a distinctive design with practical five-door utility. It gained a niche following among drivers looking for something different, and it was even considered quirky-cool at one point.

But its 2.4-litre engine generates emissions high enough to be classified in the £735 annual VED bracket, even though its performance and fuel economy were never especially impressive.

- Market value: Often under £1,500

- Annual VED: Disproportionately high compared to the car’s worth

- Sale difficulty: Most dealers refuse to take them due to unsellable status

Wayne Lamport, a car dealer who specialises in early-2000s vehicles, told The Telegraph, “A lot of these cars are virtually unsellable.” The PT Cruiser is a textbook example. Quirky appeal aside, the VED penalty has erased any chance of mainstream resale.

9. Vauxhall Zafira VXR – £735

The Vauxhall Zafira VXR combined the practicality of a seven-seater with the firepower of a performance car, a rare formula in the early 2000s.

It featured a 2.0-litre turbocharged engine with sharp handling, delivering an unusually sporty driving experience for a family car.

Unfortunately, the very characteristics that made it fun to drive also raised its CO2 emissions. That puts the Zafira VXR in the £735 annual VED range, making it one of the most heavily taxed MPVs in the UK.

- CO2 emissions: Just above the 225g/km threshold

- Practicality vs Tax: Seven seats, but a steep annual cost

- Used value: Rare but low resale due to VED deterrent

It’s especially frustrating for families who want both practicality and driving enjoyment. Few other vehicles offered such a combination at the time, and yet it’s now one of the hardest to justify keeping due to taxation alone. For many, this unique blend of power and space is now out of reach financially.

10. Ford Mondeo V6 – £735

The Ford Mondeo V6 was once the staple of British roads. Whether in company fleets or family driveways, its 2.5 and 3.0-litre variants delivered smooth, understated performance in a solid, practical package. Many owners remember these cars as trustworthy workhorses.

Today, though, that large-displacement engine puts the Mondeo V6 in the £735 VED category, despite the car itself being worth far less.

- Engine size: 2.5L to 3.0L depending on variant

- Tax burden: Annual cost rivals or exceeds insurance

- Reputation: Still appreciated for comfort and reliability

This is one of the clearest examples of how emissions-based tax doesn’t account for real-world utility or affordability. The Mondeo wasn’t a sports car. It wasn’t a luxury indulgence. But it’s now taxed as though it were a V8 SUV. For budget-conscious owners, this turns a dependable saloon into a liability.

High-End Models That Will Face VED Hikes In 2026

While some attention has been placed on older vehicles, many new or recent models will be pushed into the top VED bands come 2026. These are primarily high-performance vehicles or large-engine 4x4s. Still, they show just how wide-ranging the tax impact can be.

Here’s a list of notable models, all of which emit over 255g/km of CO2 and will incur the £790 first-year VED rate starting April 2026:

Make & Model Engine Specification

Audi RS6 4.0 TFSI V8 4.0L Twin Turbo V8

McLaren GT 4.0T V8 4.0L Twin Turbo V8

Ford Ranger 3.0 TD EcoBlue 3.0L Turbo Diesel V6

Mercedes-Benz G63 AMG 4.0L Twin Turbo V8

Jeep Wrangler 2.0 GME 2.0L Turbo Petrol

Lamborghini Urus 4.0 BiTurbo 4.0L V8

Toyota Land Cruiser 2.8D 2.8L Diesel

Bentley Continental 6.0 W12 6.0L W12

Porsche Macan 2.9T V6 2.9L Twin Turbo V6

INEOS Grenadier 3.0P 3.0L Petrol

The impact is expected to be minimal on ultra-luxury buyers, but it signals a clear message from the government: no matter the brand or buyer, high emissions will cost you.

How VED Affects Resale Value And Insurance?

The ripple effects of the VED system aren’t limited to annual tax bills. They influence the broader financial viability of owning certain vehicles, especially those now viewed as high-risk due to tax classification.

For example:

- Resale values have plummeted on cars registered after 2006 with high CO2 emissions

- Many used car dealers avoid stocking high-VED models altogether

- Insurance premiums have crept up for vehicles in higher tax bands due to perception of risk

Wayne Lamport, who runs Stone Cold Classics in Kent, sees these consequences daily in his business. His dealership focuses on cars from the early 2000s, a sweet spot for enthusiasts but a red zone for the taxman.

He explained:

“We have to be very careful when we buy stock which is 2006 or more recent. Cars such as a Jaguar X-Type are great, but who wants to pay more than £700 for the annual tax? It doesn’t take many years of ownership to spend the value of the car.”

He added that even quirky favourites like the Chrysler PT Cruiser are now almost impossible to move:

“A lot of people love them and think it will be a novelty, but they go off the idea when they realise the annual cost of taxing it. A lot of these cars are virtually unsellable.”

As a result, more vehicles are either being scrapped early or exported abroad, particularly to countries where emissions-based taxation is less severe. In both cases, the UK loses out on usable vehicles and potential classic car heritage.

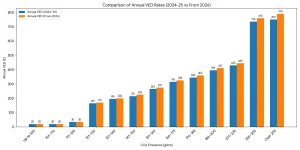

Tax Bands 2026–2027: Updated Charges At A Glance

The following table provides an overview of the upcoming VED increases for cars registered between March 1, 2001 and April 1, 2017. These changes will affect hundreds of thousands of vehicles on UK roads:

CO2 Emissions (g/km) Annual VED (2024–25) Annual VED (From 2026)

Up to 100 £20 £20

101–110 £20 £20

111–120 £35 £35

121–130 £165 £170

131–140 £195 £200

141–150 £215 £225

151–165 £265 £275

166–175 £315 £325

176–185 £345 £360

186–200 £395 £410

201–225 £430 £445

226–255 £735 £760

Over 255 £750 £790

The focus of the increases remains at the high-emission end of the scale. However, even middle-band vehicles are starting to see incremental hikes that will add up over time.

What Can Drivers Do? My Practical Advice?

For most drivers, avoiding high VED entirely isn’t realistic. However, with careful planning and smarter buying decisions, it’s possible to reduce its impact.

Here are strategies I’ve personally applied:

- Research before buying: Use online CO2 emissions databases to verify tax bands before purchase

- Factor in long-term ownership costs, not just upfront price

- Consider hybrid or mild hybrid options that fall below 150g/km CO2

- Use DVLA tools to check exact tax costs on specific number plates

After selling my Forester, I moved to a more efficient estate car. I gave up some power and AWD functionality, but my annual tax dropped by over £500. It wasn’t an emotional choice, it was a logical one.

For those who love their older cars, there’s nothing wrong with holding on a bit longer. But be aware of the rising financial penalties and weigh them against your driving needs.

Conclusion

The UK’s VED system is increasingly pricing older, still-capable vehicles off the road. While designed to cut emissions, it’s hitting everyday drivers with high costs for cars they’ve long relied on.

As we approach the 2026 tax hike, it’s vital for car owners to assess their vehicle’s long-term viability.

Whether you’re holding onto a favourite or considering a change, understanding your tax band now can save you significant money, and frustration in the years ahead.

FAQs About High Car Tax Vehicles in the UK

What is Vehicle Excise Duty (VED) based on?

VED is calculated primarily on your car’s CO2 emissions. The higher the emissions, the higher your tax.

Are electric vehicles exempt from road tax in 2026?

From 2025, electric vehicles will no longer be fully exempt and will start paying the standard VED rate.

Why are certain old cars more expensive to tax?

Cars with higher CO2 emissions registered before April 2017 fall into high tax bands, regardless of their current market value.

What happens after the first-year car tax?

New cars pay a higher first-year rate based on emissions, followed by a lower standard annual rate (currently around £200).

Is it better to keep or scrap a high VED car?

If the car is reliable and well-maintained, keeping it may still be more economical than buying new, even with high VED.

Will car tax increase again after 2026?

It’s likely. The government typically reviews VED bands annually, especially to support environmental targets.

Can classic car status reduce VED costs?

Yes. Cars over 40 years old can be exempt from VED and MOTs, but only if they meet eligibility criteria.

Leave a Reply