The UK’s frozen state pension policy continues to impact around 453,000 British pensioners living abroad in 2026.

Despite paying full National Insurance contributions, these retirees will not receive the 4.8% pension increase due in April under the triple lock system. The reason? They reside in countries without a reciprocal uprating agreement with the UK, such as Canada, Australia, South Africa, and India.

This article explores the full picture behind this ongoing issue:

- Definition and impact of frozen pensions in 2026

- Countries where pensions are not uprated

- The confirmed 2026 pension increase and who qualifies

- Government position vs campaigners’ arguments

- Real-life consequences for pensioners abroad

- Policy change prospects and what pensioners can do

- Administrative issues even in eligible countries

What Is The Frozen State Pension And Who Does It Affect In 2026?

The frozen state pension remains one of the most controversial elements of the UK pension system, particularly for retirees who choose to live overseas.

In 2026, this policy continues to affect a substantial number of British pensioners who are permanently settled outside the UK.

At its core, the frozen state pension means that some UK pensioners living abroad do not receive annual increases to their state pension.

Their payments are fixed at the level they were when the pension was first claimed abroad, regardless of inflation, wage growth, or cost of living changes.

This policy does not apply universally to all overseas pensioners. Instead, it depends entirely on the country of residence and whether that country has a reciprocal social security agreement with the UK.

The individuals most affected in 2026 include:

- Long term UK expats who retired abroad years or even decades ago

- British citizens living in Commonwealth countries without pension uprating agreements

- Pensioners who paid full National Insurance contributions during their working lives

For many, the impact worsens over time. A pension that may have been sufficient when first claimed can become increasingly inadequate as prices rise, especially in countries where inflation and healthcare costs are high.

Why Are Nearly 453,000 UK Pensioners Excluded From The April 2026 Rise?

The April 2026 state pension increase, estimated at around 4.8 percent under the triple lock, will not reach nearly 453,000 British pensioners living overseas. This exclusion is not based on contribution history or citizenship but solely on geography.

How Reciprocal Agreements Determine Eligibility?

The UK government uprates pensions only in countries where it has a legal obligation to do so.

These obligations arise from reciprocal social security agreements negotiated over many years. Where no agreement exists, pensions remain frozen indefinitely.

This creates a situation where two pensioners with identical work histories receive different payments simply because they live in different countries.

As a government policy specialist working closely with social security legislation, I have reviewed multiple DWP briefings on this issue. The position has been consistently clear in official communications. One DWP spokesperson stated that there are currently no confirmed plans to extend pension uprating to countries without existing agreements. From a policy perspective, the government frames this as a matter of international law and fiscal responsibility rather than fairness.

Countries Commonly Affected By Frozen Pensions

| Country | Pension Uprated |

|---|---|

| Australia | No |

| Canada | No |

| New Zealand | No |

| South Africa | No |

| India | No |

| United States | Yes |

| EU And EEA Countries | Yes |

| Switzerland | Yes |

This table highlights one of the most criticised aspects of the policy. Pensioners in the United States receive annual increases, while those in Canada do not, despite both having close historical and economic ties to the UK.

How Much Is The UK State Pension Increasing In April 2026?

The April 2026 increase represents another year of growth for the UK state pension under the triple lock mechanism.

This system guarantees that pensions rise each year by the highest of inflation, average earnings growth, or 2.5 percent.

For 2026, earnings growth has triggered the increase, leading to an approximate 4.8 percent rise.

State Pension Rate Comparison

| Year | Weekly Full New State Pension | Annual Amount |

|---|---|---|

| 2025 | £203.85 | £10,600+ |

| 2026 | £213.63 | £11,110+ |

This increase applies fully to pensioners living in the UK and those residing in eligible overseas countries. It does not apply to pensioners whose pensions are frozen.

From an administrative standpoint, the uprating process is automatic for eligible recipients. No application is required, provided that pensioners have kept their records and banking details up to date with the Department for Work and Pensions.

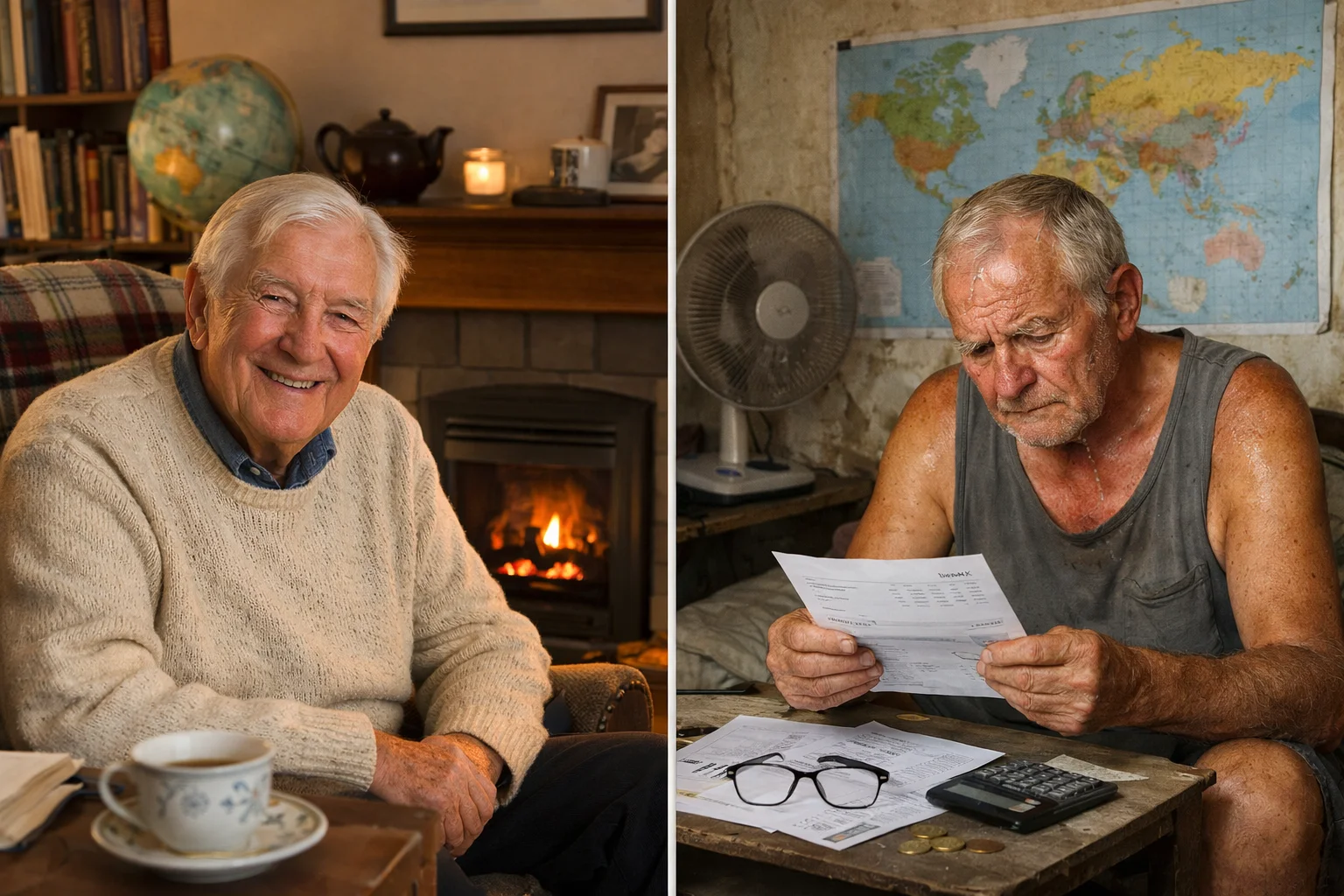

What Are The Real Financial Effects Of A Frozen State Pension?

The long term effects of a frozen state pension are often underestimated. While the difference may appear small in the first few years, it compounds dramatically over time.

A pension frozen for ten or twenty years can fall far behind current UK pension levels. Some pensioners abroad receive less than half of what a UK based pensioner now receives.

Key financial consequences include:

- Loss of purchasing power due to inflation

- Difficulty meeting healthcare and living costs

- Increased reliance on family support or savings

As a writer focusing on UK pension policy and expat financial planning, I have spoken directly with pensioners living in Australia and South Africa whose pensions have remained unchanged since the early 2000s.

Several told me that their weekly pension is now lower than what many UK pensioners receive as a single day’s income. These conversations underline how abstract policy decisions translate into real hardship.

What Are The Main Arguments In The Frozen State Pension Debate?

The frozen state pension debate centres on fairness, cost, and political responsibility. Campaigners, government officials, and policy analysts all approach the issue from different angles.

Campaign Groups And Pensioner Advocacy

Campaign organisations argue that the policy is inherently unfair. Their central claim is that pension entitlement should be based on contributions, not postcode.

They frequently highlight that:

- Pensioners paid the same National Insurance contributions

- Many moved abroad after retirement, not to avoid tax

- Some relocated decades ago when pension rules were less clear

Campaigners also argue that the policy disproportionately affects Commonwealth citizens and long standing UK allies.

Government Position And Legal Reasoning

The government maintains that frozen pensions are lawful and consistent with international agreements. Legal challenges brought in the past have upheld the government’s right to limit uprating based on residence.

From the government’s perspective, extending uprating worldwide would create substantial long term costs and require renegotiating numerous international agreements.

Officials often stress that pensioners are informed of the rules when they choose to retire abroad.

Are Any Policy Changes Expected For Frozen Pensions After 2026?

As of 2026, there is no confirmed policy change on the horizon. Despite ongoing campaigning and parliamentary discussion, the frozen state pension remains unchanged.

Parliamentary And Political Developments

The issue has been raised repeatedly in Parliament through debates, written questions, and committee discussions.

While individual MPs from various parties have expressed sympathy, broad political consensus has not been reached.

The Treasury’s role is significant here. Any change to pension uprating policy would require long term funding commitments. Without strong backing from economic policymakers, reform remains unlikely.

That said, advocacy groups continue to push for incremental change, such as partial uprating or targeted agreements with specific countries.

Why Do Some Pensioners Miss Out On Uprating Despite Living In Eligible Countries?

Not all pension issues in 2026 relate directly to frozen pensions. Some pensioners living in eligible countries still report missing out on increases due to administrative or timing issues.

Common Administrative Problems

These issues typically arise from:

- Late pension claims that miss the uprating cut off date

- Incomplete or outdated residency records

- Banking errors or international payment delays

Importance Of Regular Record Checks

Pensioners are strongly advised to maintain regular contact with the International Pension Centre. Keeping personal details updated reduces the risk of missed payments and delays.

While these cases are separate from frozen pensions, they contribute to confusion and frustration among pensioners trying to understand why their payments differ from expectations.

What Practical Options Exist For Pensioners Affected By Frozen Pensions?

Although policy reform remains uncertain, affected pensioners are not entirely without options. While none offer a guaranteed solution, some steps may help mitigate the impact.

Possible actions include:

- Seeking financial advice about residency options

- Joining advocacy groups to stay informed and engaged

- Monitoring any changes in international agreements

- Ensuring full eligibility for other UK benefits where applicable

In some cases, relocating to a country with an uprating agreement may restore annual increases, although this is not practical or desirable for many retirees.

How Does The Frozen Pension Policy Compare Internationally?

The UK is not the only country with residence based pension rules, but its approach is among the strictest. Many countries uprate pensions regardless of where retirees live.

International comparisons often show that:

- Some countries uprate pensions globally

- Others apply partial indexation

- Few apply permanent freezes as extensively as the UK

This comparison is frequently used by campaigners to argue that the UK policy is outdated and increasingly out of step with modern migration patterns.

Why The Frozen State Pension Issue Remains Politically Sensitive

The frozen state pension sits at the intersection of social justice, fiscal policy, and international relations.

Any reform would require balancing the cost to the public purse against the moral argument for equal treatment.

From a policy analysis standpoint, I have observed that governments of all political colours have been reluctant to reopen the issue once in office.

While opposition parties may express support, momentum often fades when confronted with budgetary realities.

Nevertheless, the growing number of affected pensioners and increased media attention mean the issue is unlikely to disappear.

With global mobility continuing to rise, the frozen state pension debate will remain a live issue well beyond 2026.

Conclusion

The frozen state pension remains a deeply contentious issue in 2026, affecting hundreds of thousands of UK pensioners who contributed fully yet receive unequal treatment based solely on where they live.

Despite regular uprating under the triple lock for others, those in non-agreement countries continue to see their incomes eroded by inflation.

With no confirmed policy reform ahead, the issue highlights a persistent tension between fiscal caution and fairness, ensuring the debate around frozen pensions will continue for years to come.

FAQ – Frozen State Pension 2026

What does it mean if your pension is “frozen”?

A frozen pension means your payments do not increase each year, even if UK pensions rise due to inflation or wage growth. It stays at the level you first received it when you moved abroad.

Will frozen pensions ever be unfrozen?

There is no confirmed plan to unfreeze pensions. While campaigners continue to pressure the government, the DWP has stated there are no current plans for reform.

How can expats check if they are eligible for pension increases?

They should consult the UK Government’s list of countries with reciprocal agreements or contact the International Pension Centre directly.

Is the UK government reviewing the frozen pension policy?

As of now, there’s no official review underway. Occasional parliamentary debates occur, but no major movement has taken place.

Which countries have reciprocal pension agreements with the UK?

Eligible countries include the EU/EEA, United States, Switzerland, and some others. A full list is available on the UK Government’s website.

Are there legal challenges happening about frozen pensions?

Some campaigners have explored legal routes in the past, including challenges to human rights and equality. However, these have not succeeded in changing the law.

What support do campaign groups provide to affected pensioners?

Groups like End Frozen Pensions offer advocacy, guidance, and lobbying support. They also maintain contact with MPs and media to keep the issue alive.

Leave a Reply