If you’ve spotted “DWP AA” on your bank statement, it simply refers to Attendance Allowance, a tax-free, non-means-tested benefit from the Department for Work and Pensions (DWP).

It’s paid to people over State Pension age who have a disability or long-term health condition that affects their ability to care for themselves.

I discovered this while helping a family member and realised many others are just as confused. Here’s what this payment means and why it appears:

- DWP AA = Attendance Allowance

- Paid to people aged 66+ with care needs

- Doesn’t depend on income or savings

- Paid every 4 weeks and sometimes backdated

- Can appear unexpectedly on bank statements

- Helps cover personal care or supervision costs

- May lead to additional benefits

What Does DWP AA Mean On A Bank Statement?

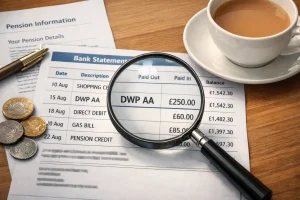

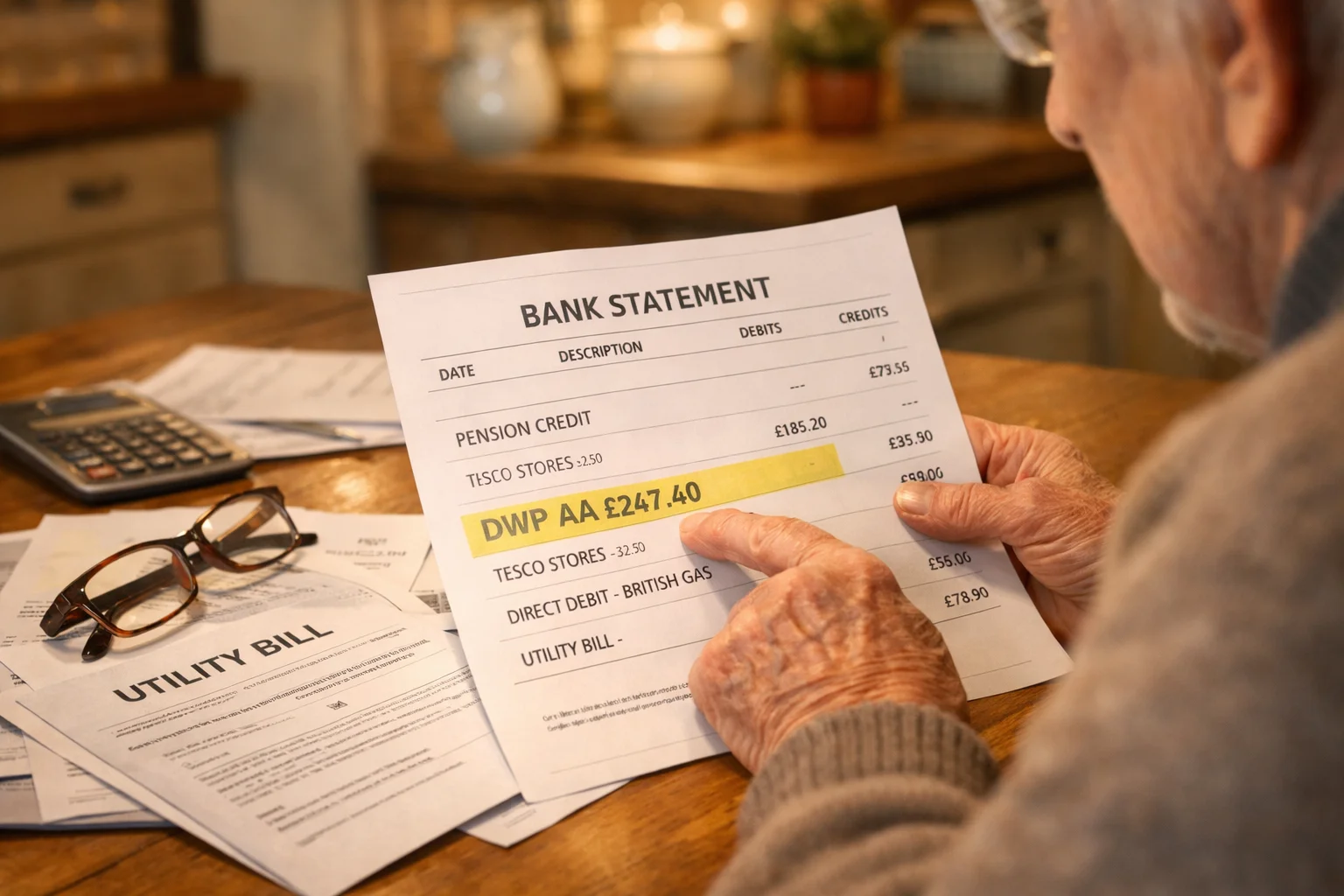

When the letters “DWP AA” appear on a bank statement, many people assume it could be a mistake, a refund, or even a suspicious transaction.

In reality, it’s a legitimate payment from the Department for Work and Pensions and refers specifically to the Attendance Allowance.

I learned this first-hand when I was helping a relative manage their finances and spotted a transaction labelled “DWP AA” in their current account.

After doing some research and making a few calls, I discovered it was backdated financial support for their recently approved Attendance Allowance application.

The DWP uses this abbreviation when issuing payments for those over State Pension age who have a disability or long-term health issue that affects their daily living.

In many cases, recipients may not even recall applying, particularly if a family member or carer helped them complete the paperwork.

So if you see DWP AA on your bank statement or on behalf of someone else, it’s worth knowing that it reflects genuine support tied to care and medical needs.

When I called the Attendance Allowance helpline to clarify the nature of the payment, the DWP representative was very clear. According to them,

“DWP AA is a straightforward identifier that tells you the money has been issued as part of an Attendance Allowance award. It is a non-repayable benefit and is only sent out to people who have passed the eligibility checks.”

How Does Attendance Allowance Work In The UK?

Attendance Allowance is a non-means-tested, tax-free benefit designed for individuals aged 66 or older who need help with personal care due to illness, disability, or frailty.

It’s managed by the Department for Work and Pensions and is one of the most underclaimed benefits in the UK, possibly because many people are unaware they qualify.

What makes this allowance particularly valuable is that it’s granted based on need, not on your current care arrangements.

This means even if you don’t receive any external care or assistance, you can still qualify if you can demonstrate the level of help you would reasonably require.

Some of the key criteria include:

- You must have a physical disability (including sensory issues), a mental disability, or both

- Your condition must be severe enough that you need help with daily personal tasks such as eating, dressing, or bathing, or supervision to keep you safe

- You must have required this level of help for at least six months (unless you’re applying under the special rules for end of life)

The DWP may also ask for information from your GP or medical professional to assess the impact of your condition on your daily life. However, in most cases, no medical examination is needed.

This financial support can be used however the recipient chooses. There’s no requirement to spend the money on care services, which offers flexibility for elderly people trying to manage various additional costs.

How Much Is Attendance Allowance Per Month?

Attendance Allowance is paid weekly, but many people understandably think of it in terms of monthly income. There are two different rates: the lower rate and the higher rate, which depend on how much care you need.

Here is a detailed breakdown:

| Attendance Allowance Rate | Weekly Amount | Monthly Estimate | Applicable Circumstances |

|---|---|---|---|

| Lower Rate | £73.90 | £295.60 | If you need help or supervision during the day OR night |

| Higher Rate | £110.40 | £441.60 | If you need help or supervision during both day AND night, or if you’re terminally ill |

In my relative’s case, they qualified for the lower rate because they needed daily help with tasks like bathing and managing medications, but not necessarily supervision at night.

The allowance can be used for anything that helps improve your quality of life, from mobility aids to help with household tasks or even occasional respite care.

It doesn’t affect your other benefits negatively and can, in fact, trigger eligibility for additional support like:

- Pension Credit

- Housing Benefit

- Council Tax Reduction

- Carer’s Allowance (for someone who supports the claimant)

What Factors Determine The Rate?

There are no income thresholds or savings limits involved. The key factor in determining the payment rate is the level of care or supervision you need, not whether you are actually receiving it.

The lower rate applies when help is needed either during the day or night. The higher rate is reserved for more extensive needs, such as around-the-clock care or serious medical conditions recognised under end-of-life criteria.

One important detail I learned from a DWP advisor was that even supervision to prevent harm qualifies.

For example, if someone has dementia and needs someone to keep an eye on them during the day, that’s valid grounds for eligibility, even if they don’t need physical assistance.

Can The Amount Change Over Time?

Yes, and it’s critical to inform the DWP about any changes in your health or care situation. If your condition worsens, you may become eligible for the higher rate.

Likewise, if your need for care reduces significantly, your allowance might be reassessed and lowered.

Examples of changes that should be reported include:

- Moving into a care home

- Being hospitalised for an extended period

- Medical condition improving or deteriorating

- Moving abroad permanently or for longer than four weeks

- Beginning to receive publicly funded care

Failing to report a change can lead to overpayment issues, which may need to be repaid.

How Often Is DWP AA Paid?

Payments are made every four weeks and are directly deposited into the recipient’s bank or building society account.

While this might seem like a minor administrative detail, the payment schedule can be important for budgeting.

In my case, the first payment we received for my relative was significantly larger than expected. That’s because the DWP had backdated the payments to the original claim date, which is common practice once the claim is approved.

The payment reference typically includes “DWP AA” followed by some alphanumeric codes. While each bank may display this slightly differently, it almost always includes the “DWP” tag, identifying it as a government benefit.

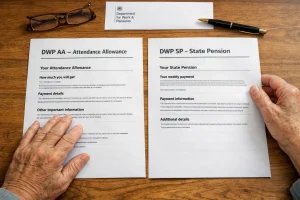

What’s The Difference Between DWP AA And DWP SP?

When managing finances, it’s common to see multiple DWP references on a statement, and this can create confusion. So let’s clarify:

- DWP SP refers to State Pension. This is the regular retirement income paid to people once they reach State Pension age, based on their National Insurance contributions.

- DWP AA refers to Attendance Allowance, a separate benefit aimed at supporting people who need help due to illness or disability.

It is entirely possible to receive both payments at the same time. In fact, many individuals do.

Understanding the difference is crucial because some people mistakenly believe they’re only entitled to one DWP benefit at a time. That’s not the case. The two are separate entitlements with different eligibility criteria.

How Do I Claim Attendance Allowance?

The process of claiming Attendance Allowance is relatively straightforward, but it does require attention to detail. Applications can be submitted by post, or you can request a form by phone.

Here’s what the application involves:

- Fill out the Attendance Allowance claim form (either printed or requested from DWP)

- Provide medical and personal information, including:

- National Insurance number

- Full address and contact details

- Details of the health condition or disability

- GP or medical professional contact information

- Care home or hospital details if applicable

Once submitted, the DWP may contact you for additional information or to arrange an assessment if more clarity is needed. However, in most cases, a paper application supported by a medical note is sufficient.

Do I Need A Medical Assessment?

Usually, no. The DWP only schedules a face-to-face or telephone assessment if it’s unclear from your form and supporting documents how your condition affects your daily life. This can be reassuring for older applicants who may not be comfortable attending formal assessments.

How Long Does It Take To Process A Claim?

The processing time for Attendance Allowance claims is typically between 8 and 10 weeks. If you apply under the special rules for end-of-life care, the process is expedited and often resolved in under two weeks.

Who Is Eligible For Attendance Allowance?

Eligibility isn’t based on income, assets, or even a formal diagnosis. What matters most is how your health condition impacts your day-to-day ability to care for yourself.

To qualify, you must:

- Be State Pension age or older

- Have been in the UK for at least 2 of the past 3 years

- Be habitually resident in the UK, Ireland, Isle of Man, or Channel Islands

- Not be subject to immigration control (unless you’re a sponsored immigrant)

- Not be claiming DLA, PIP, ADP, or AFIP

The table below outlines the essential eligibility requirements:

| Requirement | Details |

|---|---|

| Age | Must be over State Pension age (currently 66) |

| Residency | Must live in Great Britain or qualifying territories |

| Condition Duration | Must have needed care or supervision for at least 6 months |

| Type of Disability or Illness | Physical, sensory, or mental (including dementia, arthritis, blindness) |

People living in Scotland should note that Attendance Allowance has been replaced by the Pension Age Disability Payment, though the criteria are very similar.

Can I Receive Attendance Allowance In A Care Home Or Abroad?

Yes, but with some important conditions.

If you’re in a care home and paying for your own care, you can still receive Attendance Allowance. However, if the care is fully funded by the local authority or NHS, you usually cannot receive AA during that period.

Similarly, if you move abroad, you may still be eligible under specific agreements if you reside in the EU, EEA, Switzerland, Norway, or Iceland, and you’re a UK national. However, it’s essential to check with the DWP, as this area can be complex.

Attendance Allowance is not designed to follow you indefinitely outside the UK. If you’re planning to leave the country for more than four weeks, it’s essential to notify the DWP, or you may risk overpayments and penalties.

Conclusion

The DWP AA entry isn’t a random deposit it’s financial support for people facing the real-life costs of disability and old age.

If you’re seeing it, it likely means someone has recognised your need and helped secure this benefit on your behalf. And if you think you or someone you know might be eligible, now’s the time to explore it further.

FAQs about DWP AA and Attendance Allowance

Is DWP AA taxable?

No, Attendance Allowance is completely tax-free and does not affect your tax status.

Can you get DWP AA and PIP together?

No, you cannot claim both. If you’re already receiving PIP or DLA, you’re not eligible for Attendance Allowance.

How long does it take to receive Attendance Allowance after applying?

It usually takes around 8–10 weeks. If you apply under special rules for terminal illness, it’s much faster.

Does Attendance Allowance affect other benefits?

No, but it may help you qualify for extra support like Pension Credit, Housing Benefit, or Council Tax Reduction.

Can carers claim extra support if I receive AA?

Yes, if someone looks after you, they might be eligible for Carer’s Allowance, depending on their circumstances.

Why would DWP stop paying Attendance Allowance?

Common reasons include entering a fully funded care home, going abroad for over 4 weeks, or recovery from your condition.

Is there an online portal to track my DWP payments?

Currently, there is no dedicated portal for tracking AA payments, but you can contact the helpline or check your bank statements for DWP entries.

Leave a Reply