Are you overwhelmed trying to choose the right business accounting software for your small business in the UK? With so many options available, each offering a mix of pricing, features, and compliance benefits, it can be hard to know which one best fits your unique needs. Whether you’re a sole trader, freelancer, or growing SME, using the right accounting software is no longer optional.

Under Making Tax Digital (MTD), all VAT-registered businesses must now maintain digital records and submit VAT returns using HMRC-recognised platforms.

From automating invoicing to integrating payroll and submitting taxes, modern accounting tools simplify your financial admin, saving you time and money. In this guide, we’ve reviewed the top 10 small business accounting software solutions in the UK to help you compare prices, pros, and features, so you can make an informed decision with confidence.

What is the Best Accounting Software for Sole Traders in the UK?

If you’re a sole trader in the UK, your accounting needs are typically simpler than larger businesses, but that doesn’t mean accuracy is any less important. The best accounting software for sole traders offers essential tools like invoicing, expense tracking, and HMRC-compliant VAT filing, all in an easy-to-use format.

FreshBooks, Ember, and Zoho Books stand out for their affordability, automation, and clean interfaces. FreshBooks offers a self-service client portal and great usability, while Ember automates tax insights and includes in-house accountant support. Zoho Books is ideal if you also deal with international clients due to its multi-currency support.

Look for MTD-readiness, mobile access, and a pricing plan that matches your client volume. While free plans exist, paid software typically ensures better data protection and full HMRC compliance, both crucial for staying on top of your tax obligations as a sole trader.

How Do I Choose the Right Accounting Software for My Small Business?

Choosing the right accounting software for your small business begins with assessing your operational needs and future plans. Start by identifying must-have features such as invoicing, VAT filing, payroll, or multi-currency support. If you’re a VAT-registered business, ensure the software is MTD-compliant and HMRC-recognised.

Cost is a major consideration, but don’t just opt for the cheapest option. Consider scalability, user limits, and customer support quality. For example, Sage is excellent for microbusinesses, while Xero and QuickBooks cater better to growing SMEs. If you’re looking for an all-in-one tool with banking and accounting, Tide might suit you.

Always explore trial periods and request demos. Ask vendors key questions about data backup, support response times, and foreign currency handling. Choosing wisely ensures you stay compliant, efficient, and ready to grow without the hassle of switching platforms later.

Do I Need Accounting Software for Making Tax Digital Compliance?

Yes, if you run a VAT-registered business in the UK, you must use accounting software that is MTD-compliant to stay within HMRC regulations. Making Tax Digital (MTD) requires you to keep digital records and file VAT returns through approved software. As of now, all VAT-registered businesses are affected, and from April 2026, those earning over £50,000 will be required to comply with MTD for Income Tax.

Accounting software like Xero, Sage, QuickBooks, and Zoho Books are all recognised by HMRC and offer MTD functionality. These platforms also help you automate calculations, track VAT liabilities, and reduce errors.

Even if you’re not required to comply yet, switching early helps you get used to digital bookkeeping, ensuring a smoother transition when MTD becomes mandatory for your business. It’s not just a legal move, it’s a strategic one to streamline your finances.

10 Business Accounting Software for Small Business

1. Sage Accounting – Best for Micro Businesses with Limited Stock

When you’re running a microbusiness or sole trading operation, Sage Accounting offers the simplicity and compliance you need without sacrificing functionality. This HMRC-recognised, MTD-compliant software lets you manage invoices, reconcile accounts, and forecast cash flow from one dashboard. It’s especially suitable if you need to stay on top of VAT returns and digital recordkeeping.

Key features include:

- Automated invoice creation and tracking

- Cash flow forecasting and expense management

- Seamless bank account integration for real-time reconciliation

- AI Copilot that automates reminders, email creation, and VAT return generation

- Connection with Stripe for payment processing

While Sage Business Cloud Accounting is user-friendly and robust, payroll comes as an add-on starting at £10 per month. The interface is simple to navigate and includes visual reporting tools to help you understand your financial performance instantly.

Its three plans like Start (£18/month), Standard (£39/month), and Plus (£59/month) which allow you to scale as your business grows, all offering free trials for the first three months. If you value compliance, automation, and easy onboarding, Sage is a reliable choice for your small business accounting software needs.

2. Xero – Best for Growing SMEs with Multiple Users

Xero is one of the most widely used cloud-based accounting platforms for small businesses in the UK, ideal for companies managing multiple users or larger operations. It’s MTD-ready and integrates seamlessly with more than 1,000 third-party apps and 300+ banking partners.

You can:

- Send and reconcile invoices instantly

- Track stock and purchase orders

- Generate and customise financial reports

- Integrate payroll for up to ten employees

- Access a marketplace of apps including Shopify, Stripe, and PayPal

Pros include its scalability and extensive add-ons for expanding teams. However, the Starter plan is limited, offering few invoices and no access to payroll or multi-currency features. Pricing ranges from £16 to £65 per month after discounts.

While Xero lacks phone support, its web and community assistance compensate for this. It’s particularly well suited to sales-oriented businesses that require live data and advanced analytics. With its real-time updates and secure access from any device, Xero makes managing your business finances faster and more collaborative.

3. Tide – Best for Integrated Banking and Accounting

Tide combines business banking and accounting in a single app, helping small businesses automate day-to-day financial tasks. Its integration allows you to manage cash flow, invoices, and VAT filing without needing multiple tools.

Key features:

- Combined banking and bookkeeping dashboard

- Automated transaction categorisation

- VAT filing and Self Assessment submission to HMRC

- Real-time profitability and tax insights

- Bulk invoice and payment management

Tide simplifies tax compliance while reducing manual entry through smart automation. You can choose plans starting from £5.99/month up to £24.99/month depending on your business structure.

Pros include automatic expense tracking, built-in HMRC compatibility, and profitability projections. However, advanced bookkeeping and collaboration tools are restricted to higher-tier plans. If you prefer to manage finances within one central app without switching between systems, Tide’s all-in-one model makes accounting more efficient for startups and freelancers alike.

4. Moss – Best for Flexible Pricing and Expense Management

Moss is designed for small and mid-sized businesses that want to streamline spend management and accounting tasks. Unlike traditional systems, Moss uses AI-powered automation to categorise expenses, manage reimbursements, and integrate directly with your accounting software.

You’ll benefit from:

- Automated expense tracking and OCR-based invoice capture

- Unlimited virtual and physical corporate cards

- Two-way API integration for seamless reconciliation

- Centralised dashboard for expenses, approvals, and budgets

Its modular pricing means you only pay for what your business needs. The free plan supports up to three users, while larger firms can customise their package with modules such as procurement, ERP integration, and advanced accounting.

Moss helps finance teams cut manual work and month-end closing time dramatically. However, it’s primarily suited for companies with at least ten employees and an annual turnover above £2 million. For growing firms that value precision and automation in business accounting software, Moss offers a flexible and scalable solution.

5. Zoho Books – Best for International Businesses

For businesses trading internationally, Zoho Books provides multi-currency accounting, automated invoicing, and strong integration within the Zoho ecosystem. It’s also MTD-compliant and HMRC-recognised, ensuring tax submissions remain accurate.

You can:

- Submit VAT returns directly to HMRC

- Manage international invoices and auto-convert exchange rates

- Automate recurring transactions and reports

- Track inventory and stock levels in real time

- Integrate with Zoho CRM and other third-party apps

Zoho’s plans start with a free version for microbusinesses, moving up to £10–£165/month, making it one of the most affordable accounting software options for small business owners.

Its main advantages are flexibility and scalability across international markets. However, smaller businesses may find its tier limitations restrictive. If your operations involve foreign transactions or multiple revenue streams, Zoho Books provides a balance of compliance, affordability, and global reach.

6. FreshBooks – Best for Sole Traders

FreshBooks offers a clean and intuitive user interface, making it ideal for freelancers and sole traders who need a straightforward accounting system. It helps automate invoicing, expense tracking, and VAT returns without overwhelming features.

Key features:

- Client self-service portal

- Customised invoices and recurring billing

- VAT-compliant reporting

- Expense and time tracking tools

Its tiered pricing includes Lite (£15), Plus (£25), and Premium (£35) plans after introductory discounts. The lower tiers are limited to a small number of clients, while higher plans include unlimited clients and additional features such as customised email templates and subscription billing.

Although FreshBooks lacks some enterprise-level features, it’s praised for its usability and simplicity. If you’re a self-employed professional who wants quick invoicing and tax-ready records, this software streamlines financial management while keeping you compliant with HMRC standards.

7. Crunch – Best for Ease of Use

Crunch combines online accounting software with access to Chartered Certified Accountants, providing a hybrid solution for small businesses in the UK. It’s ideal for those who prefer professional support alongside MTD-ready automation.

You can:

- Create and send invoices easily

- Record expenses and reconcile bank accounts

- Access VAT and Self Assessment submission tools

- Consult accountants for HMRC registration or compliance issues

Plans start from £21.60/month for sole traders, rising to £109.60/month for limited companies. Crunch’s 14-day trial allows you to test all features without commitment.

Pros include accountant access and unlimited invoicing; however, payroll requires an additional fee. It’s perfect for freelancers and limited companies seeking both digital and human expertise in managing their business finances efficiently.

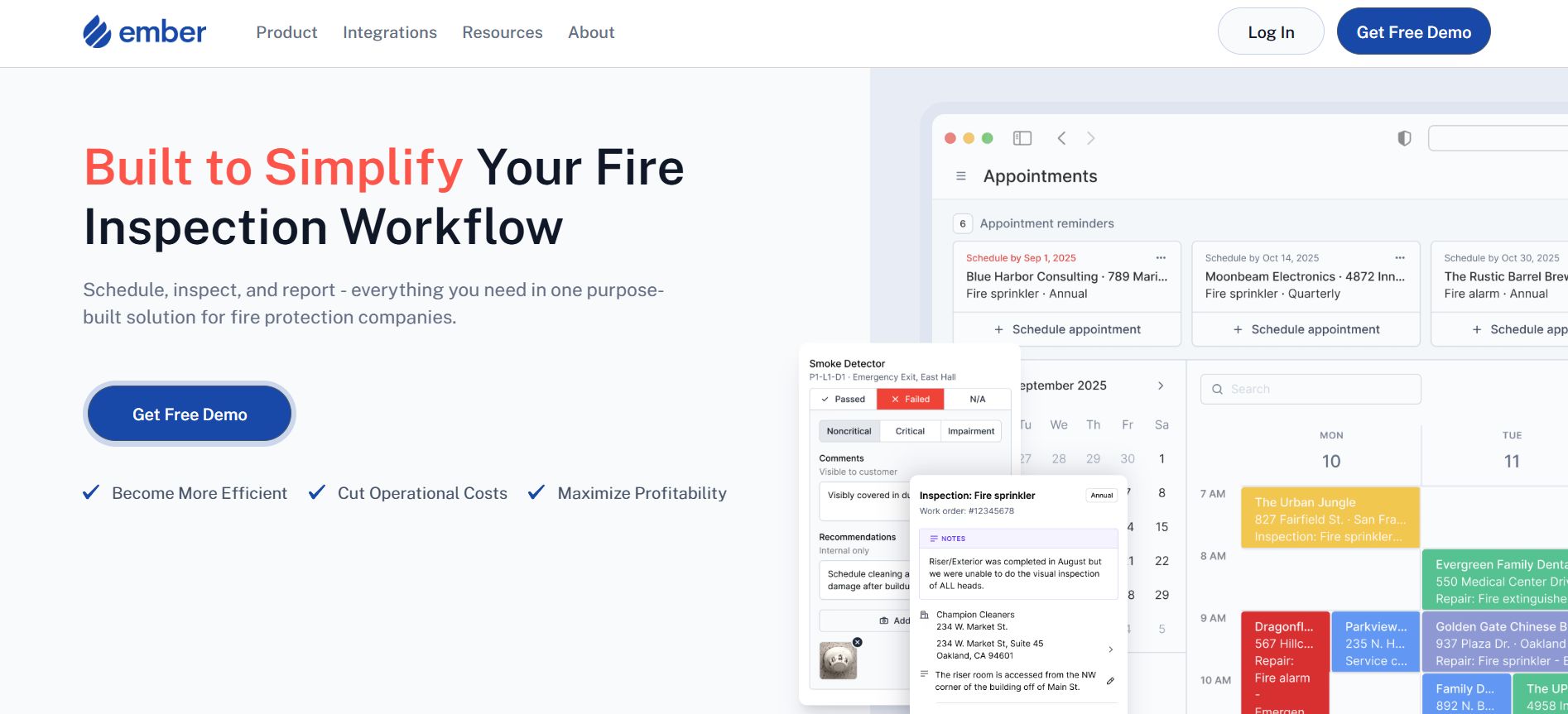

8. Ember – Best for All-in-One Accounting

Ember automates accounting and tax processes for both sole traders and limited companies. It’s MTD-ready and integrates open banking, allowing real-time financial management from one central dashboard.

You’ll benefit from:

- Automated expense categorisation

- Real-time financial reporting

- Direct VAT return submission to HMRC

- Integrated payroll and tax insights

- Multi-currency support

Ember’s flexibility allows you to scale without long-term contracts. Its biggest advantage is simplicity—tasks like invoicing and VAT filing take minutes instead of hours. Multi-user access is currently limited, but its affordability and inclusion of accountant support make it one of the strongest all-in-one accounting platforms for small business owners in the UK.

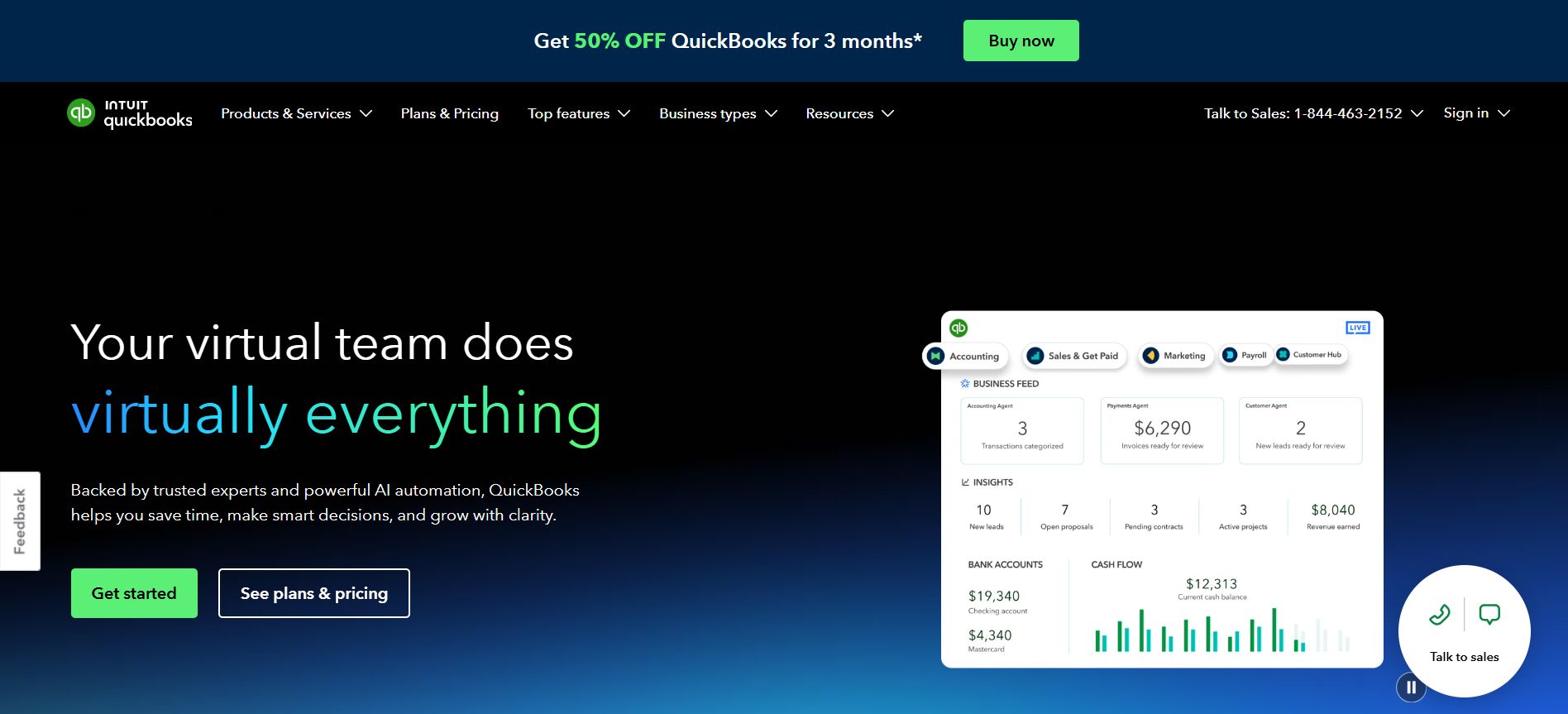

9. QuickBooks – Best for Fast-Growing Businesses

QuickBooks is a well-established cloud-based accounting software designed for scalability. It offers built-in CRM tools, AI-driven expense categorisation, and highly customisable financial reporting, ideal for small businesses expecting growth.

Core features include:

- AI-assisted income and expense tracking

- Client portal for invoice payment and downloads

- Real-time cash flow insights

- Advanced reporting on profit, loss, and expenses

QuickBooks’ plans start as low as £1/month for the first six months, with full prices ranging up to £115/month depending on features. It supports up to 25 users, making it one of the most scalable tools in this category.

Pros include user-friendly design and powerful financial analytics. However, occasional technical glitches and limited customer service response times can be drawbacks. If you need dynamic reporting and growth-ready functionality, QuickBooks remains a leading choice in business accounting software.

10. ClearBooks – Best UK-Focused Accounting Software

ClearBooks is built specifically for British businesses seeking simple, cost-effective accounting. It’s MTD-ready, HMRC-compatible, and offers integrated payroll features for smaller teams.

You can:

- Generate invoices and manage receipts

- Track income and expenses

- Handle VAT and income tax submissions

- Add modules for payroll and project accounting

With plans starting at £15/month, ClearBooks provides solid value for sole traders and small companies. The system’s user-friendly dashboard simplifies compliance and reporting, while its support team works closely with developers to ensure continual updates.

Although it’s not ideal for enterprise-scale operations, its affordability, reliability, and UK-specific design make ClearBooks a standout for local entrepreneurs.

Conclusion

Choosing the right accounting software for your small business is vital, not just for convenience, but for legal compliance under the UK’s Making Tax Digital initiative. Each tool we’ve reviewed offers MTD support and a range of features designed for different business needs, whether you’re a freelancer needing simple invoicing or a growing SME managing payroll and expenses.

It’s important to consider what features matter most—VAT filing, multi-user access, integrations, or international support. While cost is always a factor, investing in a reliable, HMRC-compliant solution ensures peace of mind and prevents costly mistakes.

No matter your size or structure, switching to digital accounting now will set your business up for success as new tax regulations roll out. Choose the package that best fits your current needs, with room to grow as your business evolves.

FAQs

What is MTD-compliant accounting software?

MTD-compliant software is approved by HMRC to digitally record and submit VAT returns as required by the Making Tax Digital initiative. It helps small businesses maintain accurate financial records and avoid penalties.

Can I use accounting software if I’m not VAT-registered?

Yes, many accounting software platforms are suitable for non-VAT registered businesses. They still help with invoicing, expense tracking, and preparing for potential VAT registration in the future.

Is free accounting software good enough for a small business?

Free accounting tools may cover basic needs, but often lack features like VAT filing, payroll, or customer support. Paid plans provide more comprehensive services and data security.

How secure is online accounting software?

Most modern accounting software uses bank-level encryption and regular data backups. Always choose a provider with a clear data protection policy and compliance credentials.

Do I need separate payroll software?

Some accounting software like Xero and QuickBooks include payroll as part of higher-tier plans. Others may offer it as an add-on or require integration with a separate payroll system.

How many users can access small business accounting software?

User limits vary by provider and pricing tier some, like Xero, offer unlimited users. Always check the user permissions and collaboration tools included in your plan.

Can I switch accounting software easily later?

Yes, most platforms allow data export and import, making transitions manageable. However, switching may require manual checks to ensure data accuracy and MTD compliance continuity.

Leave a Reply