Have you ever needed to confirm whether a company is genuinely VAT registered? In a business environment where accuracy and trust matter more than ever, checking a VAT number is not just a procedural step.

It can protect your finances, maintain legal compliance, and ensure that you’re not dealing with a fraudulent or incorrectly reporting business.

This guide will walk you through those methods in detail, including online tools, phone services, and tips for cross-checking when you don’t have a VAT number at hand.

Why Is a VAT Number So Important for Businesses in the UK?

A VAT number is much more than a formal code issued by HMRC. It signifies that a business is recognised and authorised to collect VAT on behalf of the government. This identifier is unique to every VAT-registered business and is required for a range of financial and legal processes.

When a company surpasses the taxable turnover threshold, £90,000 as of 2025, it is required to register for VAT. Once registered, the business can charge VAT on eligible goods and services and reclaim VAT on qualifying purchases.

VAT numbers serve as proof that a business operates under regulated tax protocols. For clients and customers, seeing a VAT number builds credibility. It also ensures they can reclaim any VAT paid if they themselves are VAT registered.

Additionally, invoices issued without a valid VAT number are considered non-compliant for VAT recovery. If you claim back VAT on a transaction with an unverified or incorrect VAT number, it could lead to rejections or audits.

Businesses must also display their VAT number clearly on all official documentation, especially invoices and websites.

Ultimately, a VAT number acts as a trust signal and a financial safeguard.

What Does a UK VAT Number Look Like and What Does It Signify?

A UK VAT number typically starts with the prefix “GB”, followed by nine digits. This sequence is unique to every registered business and helps HMRC track their VAT collection and payment history.

For example, a valid VAT number may look like GB123456789. This number is associated with a specific legal entity, and no two companies will have the same one.

Since the implementation of the Northern Ireland Protocol, VAT numbers in Northern Ireland may include the prefix “XI”, which is used specifically for transactions involving the EU. This format helps distinguish domestic and cross-border VAT activity.

The structure and details of a VAT number are essential for validating a business’s registration status.

VAT Number Format Overview

| Region | Format Example | Purpose |

|---|---|---|

| UK (excluding NI) | GB123456789 | Standard for UK-based businesses |

| Northern Ireland | XI123456789 | Used for EU transactions under NI Protocol |

| EU Countries | Varies by country | Checked via the VIES platform |

When you receive an invoice, always check that the VAT number matches the issuing business and corresponds to the official structure.

How to Check if a Company is VAT Registered?

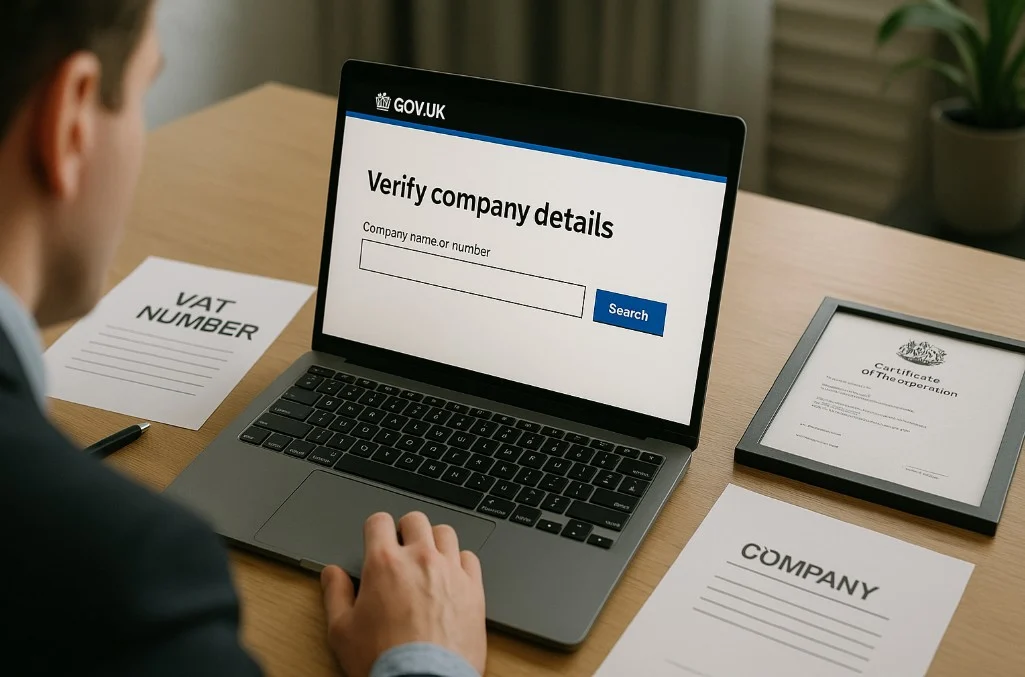

The process of checking whether a company is VAT registered in the UK is straightforward. The main tool is HMRC’s VAT registration checker, which is a public service and available online.

Many individuals use it when they want to confirm a VAT number on an invoice or before entering into a commercial relationship. Businesses use it to ensure compliance when reclaiming input VAT or vetting suppliers.

The tool requires only the VAT number in question and returns the legal name and address of the business if the number is valid. This allows you to cross-reference details and make sure they align with what the company has provided.

Additionally, if your business is also VAT registered, the system gives you a downloadable proof of check, useful during tax return submissions or audits.

If the number is invalid or not yet registered, the system will clearly state so. You cannot use this tool to check pending applications, as businesses waiting for registration approval are not yet included in the system.

How Do You Use the HMRC VAT Number Checker Online?

The HMRC VAT number checker is one of the most reliable tools for verifying UK VAT registration. It is accessible, free to use, and updated directly by HMRC.

Steps to Use the HMRC Checker

- Visit the HMRC VAT number checker website.

- Input the VAT number you want to verify.

- Review the results showing whether the number is valid.

- If valid, the tool will also display the business name and address.

- VAT-registered users can download proof of the check.

This service is also available in Welsh (Cymraeg), making it more accessible for businesses based in or operating from Wales.

If a number doesn’t appear valid, you may be dealing with a business that is either unregistered or still waiting for HMRC approval. The system also notes when the check was completed, which can help in maintaining records and ensuring VAT compliance.

The checker is particularly useful for accountants and procurement departments who want to vet suppliers before transactions.

Can You Verify a VAT Number by Calling HMRC Directly?

For those who prefer offline methods, HMRC also offers a phone support line where you can verify VAT registration status. This is especially useful in situations where digital access is limited or where you require direct human support.

You can contact the HMRC VAT helpline at 0300 200 3700 (or +44 2920 501 261 from outside the UK). Opening hours are Monday to Friday, from 8am to 6pm.

Before calling, make sure you have the following details ready:

- The VAT number in question

- The business postcode

- Your own VAT registration number, if applicable

The call system uses voice recognition software, so you will be prompted to explain your enquiry. In certain cases, you might need to answer security questions to proceed.

This is why it’s important to ensure your own business account information is up to date before contacting HMRC.

For those unable to speak or hear on the phone, HMRC supports Relay UK services by dialling 18001 then 0300 200 3700.

Is It Possible to Check a VAT Number by Using a Company’s Name?

Yes, in some cases, you can identify or confirm a VAT number using just a company name. This method is helpful when you haven’t been provided with a VAT number but need to verify a business before entering into a contract or processing a payment.

One of the easiest places to check is the company’s own website. VAT numbers are often listed in the header, footer, or on the “Terms and Conditions” or “Contact” pages. If you’ve previously received an invoice from the company, it should also contain the VAT number.

Another option is to directly contact the company and ask for their VAT number. This is a standard request, and legitimate businesses should have no issue providing it.

Websites like Companies Made Simple offer VAT lookup tools that allow you to search using a company name. These databases often rely on publicly available records to match company details with VAT information.

While this method isn’t always as immediate or reliable as using the VAT number checker, it can be helpful in cases where you’re still gathering information.

What If You Need to Validate a VAT Number from an EU Country?

If you’re dealing with a business based in the European Union, you’ll need to use the VAT Information Exchange System (VIES) instead of HMRC tools. This platform allows you to verify VAT registration for businesses located in EU member states.

As of 2025, the UK is no longer part of the EU VAT area, but businesses in Northern Ireland still fall under some EU VAT rules for goods. This means that if you’re trading with a Northern Ireland-based business, you might see a VAT number starting with “XI”.

To use the VIES tool, input the VAT number and the country code. If valid, the system will return the business name and confirmation of its registration status. Keep in mind that VIES does not offer detailed business addresses due to EU data protection rules.

If a VAT number from an EU company returns invalid, it’s important to double-check the number and consult with the supplier before proceeding with transactions.

What to Do If the VAT Number Seems Invalid or Can’t Be Found?

An invalid VAT number doesn’t always mean a business is fraudulent. There are several reasons why a check might return as “not found”.

It’s possible that the business has applied for VAT but has not yet been approved. HMRC does not display VAT numbers for pending applications. It’s also worth checking that the VAT number is entered correctly, with no extra spaces or wrong digits.

In some instances, the business may have deregistered from VAT, either voluntarily or because it no longer meets the turnover threshold.

When in doubt, contact the business directly for clarification. You may also contact HMRC for support. Always ensure that any VAT charged on invoices comes from a valid and active VAT-registered company.

Can You Access VAT Information Through Your Business Tax Account?

Yes, if you are a VAT-registered business, you can access comprehensive VAT information by logging into your HMRC Business Tax Account via the Government Gateway.

Inside your account, you can:

- Submit VAT returns

- View previously submitted returns

- Track repayments or claim statuses

- Change your VAT registration details

- Review your payment history and liabilities

This tool is highly useful for business owners and accountants managing multiple clients. It’s also the best place to check correspondence or alerts from HMRC regarding your VAT status.

Setting up a business tax account is free, and it’s advisable for all VAT-registered entities to maintain one for smoother communication with HMRC.

Who to Contact for Further VAT Help or Complex Queries?

Some VAT issues may require deeper support, especially if they involve insolvencies, international trade, or administrative errors.

HMRC Contact Options

- Digital Assistant: Available on HMRC’s website, this chatbot helps answer common VAT questions.

- Live Advisers: If the assistant cannot help, it will route you to an HMRC representative.

- By Post: You can send letters to:

BT VAT

HM Revenue and Customs

BX9 1WR

United Kingdom

Postal replies can take more than 15 working days. Include all relevant documentation to avoid delays.

In cases involving fulfilment house due diligence schemes, digital VAT issues, or Making Tax Digital compliance, specific departments will handle your request.

Conclusion

Verifying VAT registration isn’t just good business practice, it’s essential for tax compliance, financial protection, and legal accuracy.

Whether you use HMRC’s online checker, call their helpline, or examine company invoices and websites, each method offers a layer of assurance.

In a world where VAT fraud can have serious implications, taking a few extra minutes to validate a VAT number could save you from major tax issues. Make these checks part of your financial workflow, your business and peace of mind will thank you.

FAQs

How do I check a UK VAT number?

Use HMRC’s online VAT checker to validate the number and view the registered business name and address.

Can I verify VAT numbers over the phone?

Yes, HMRC offers a phone service where you can verify VAT numbers and get assistance.

Is it free to check VAT numbers?

Yes, both the HMRC and VIES platforms are free to use for checking VAT numbers.

Can I check a VAT number using a business name?

Yes, company websites and services like Companies Made Simple can help you find VAT numbers by business name.

What does an invalid VAT number mean?

It could mean the number is incorrect, unregistered, deregistered, or pending approval.

Do Northern Ireland businesses have different VAT rules?

Yes, for EU trade, they use different formats and fall under certain EU VAT regulations.

What if I can’t find any VAT information?

Try contacting the business or HMRC directly for clarification and support.

Leave a Reply